Milton Friedman and Anna Jacobson Schwartz’s A Monetary History of the United States, 1867–1960 is one of the most influential economics books of the twentieth century. A landmark achievement, it marshaled massive historical data and sharp analytics to argue that monetary policy—steady control of the money supply—matters profoundly in the management of the nation’s economy, especially in navigating serious economic fluctuations.

One of the book’s most important chapters, “The Great Contraction, 1929–33” addressed the central economic event of the twentieth century, the Great Depression. Friedman and Schwartz argued that the Federal Reserve could have stemmed the severity of the Depression, but failed to exercise its role of managing the monetary system and countering banking panics. The book served as a clarion call to the monetarist school of thought by emphasizing the importance of the money supply in the functioning of the economy—an idea that has come to shape the actions of central banks worldwide.

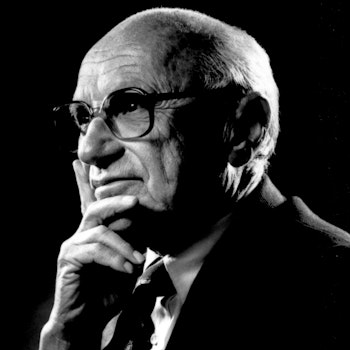

Milton Friedman (1912-2006) was awarded the Nobel Prize in Economics in 1976. He was a Senior Research Fellow at the Hoover Institution and had previously taught at the University of Chicago, from 1946 to 1976. He was also a member of the research staff of the National Bureau of Economic Research from 1937 to 1981. Anna Jacobson Schwartz (1915–2012) was a research associate at the National Bureau of Economic Research, which she joined in 1941. She is a Distinguished Fellow of the American Economic Association and a Fellow of the American Academy of Arts and Sciences. During her distinguished career, she has made major contributions to the economics of business cycles, banking, monetary policy, and financial regulation.

"The long-awaited monetary history of the United States by Friedman and Schwartz is in every sense of the term a monumental scholarly accomplishment—monumental in its sheer bulk, monumental in the definitiveness of its treatment of innumerable issues, large and small, in U.S. monetary history, monumental in the consistency and coherence of its analysis of nearly a century of drastic institutional change, monumental, above all, in the theoretical and statistical effort and ingenuity that have been brought to bear on the solution of complex and subtle economic issues. The volume sets, if not a new style, a new standard for the writing of economic history, one that requires the explanation of historical developments in terms of monetary theory and the application to them of the techniques of quantitative economic analysis. It is, moreover, written in an eminently readable style."—Harry G. Johnson, Economic Journal

"The numerical account is dexterously and gracefully interwoven with a history of monetary institutions, legislation, policies, personalities, and politics. The resulting narrative is fascinating and absorbing, and it is written in a consistently lucid and lively style. . . . This is one of those rare books that leave their mark on all future research on the subject."—James Tobin, American Economic Review

"One of the most significant books published for a long time in the field of monetary analysis."—Karl Brunner, Journal of Political Economy

“This volume must be recognized as a delight to the economist. The book is clearly destined to be a classic, perhaps one of the few emerging in that role rather than growing into it. The reader cannot fail to be impressed by the size of the task to which the authors committed themselves, by the authors’ ability to treat the broad sweep of a century of monetary history without being overcome in the mass of detail that they carefully examine, by the originality and scholarship that are everywhere displayed, and by a host of other considerations most of which are conveyed by the word ‘classic.’ ”—Allan H. Meltzer, American economist