We are living in a golden age of biomedical innovation, yet entrepreneurs still struggle with the so-called Valley of Death when seeking funding for their biotech start-ups. In Healthcare Finance, Andrew Lo and Shomesh Chaudhuri show that there are better ways to finance breakthrough therapies, and they provide the essential financial tools and concepts for creating the next generation of healthcare technologies.

Geared for MBA and life sciences students, as well as biopharma executives and healthcare investment professionals, this textbook covers the theory and application of financial techniques such as diversification, discounted cash flow analysis, real options, Monte Carlo simulation, and securitization, all within the context of managing biomedical assets. The book demonstrates that more efficient funding structures can reduce financial risks, lower the cost of capital, and bring more lifesaving therapies to patients faster. Readers will gain the background, framework, and techniques needed to reshape the healthcare industry in positive ways. Finance doesn’t have to be a zero-sum game, and Healthcare Finance proves that it is possible to do well by doing good.

- Explores new financing methods for the biopharma industry

- Provides accessible explanations for making good business decisions in the life sciences

- Analyzes real-world examples, case studies, and practical applications

- Includes access to videos of lectures and recitations, interactive figures, self-graded problem sets, and other online content

Awards and Recognition

- Finalist for the PROSE Award in Reference Works – Social Sciences, Association of American Publishers

Andrew W. Lo is the Charles E. and Susan T. Harris Professor at the MIT Sloan School of Management, director of the MIT Laboratory for Financial Engineering, and an external faculty member at the Santa Fe Institute. His books include Adaptive Markets and Hedge Funds (both Princeton). Shomesh E. Chaudhuri is a cofounder of QLS Advisors. He has published articles in such journals as the Journal of Financial Economics, the Journal of Econometrics, Management Science, JAMA Oncology, and Drug Discovery Today.

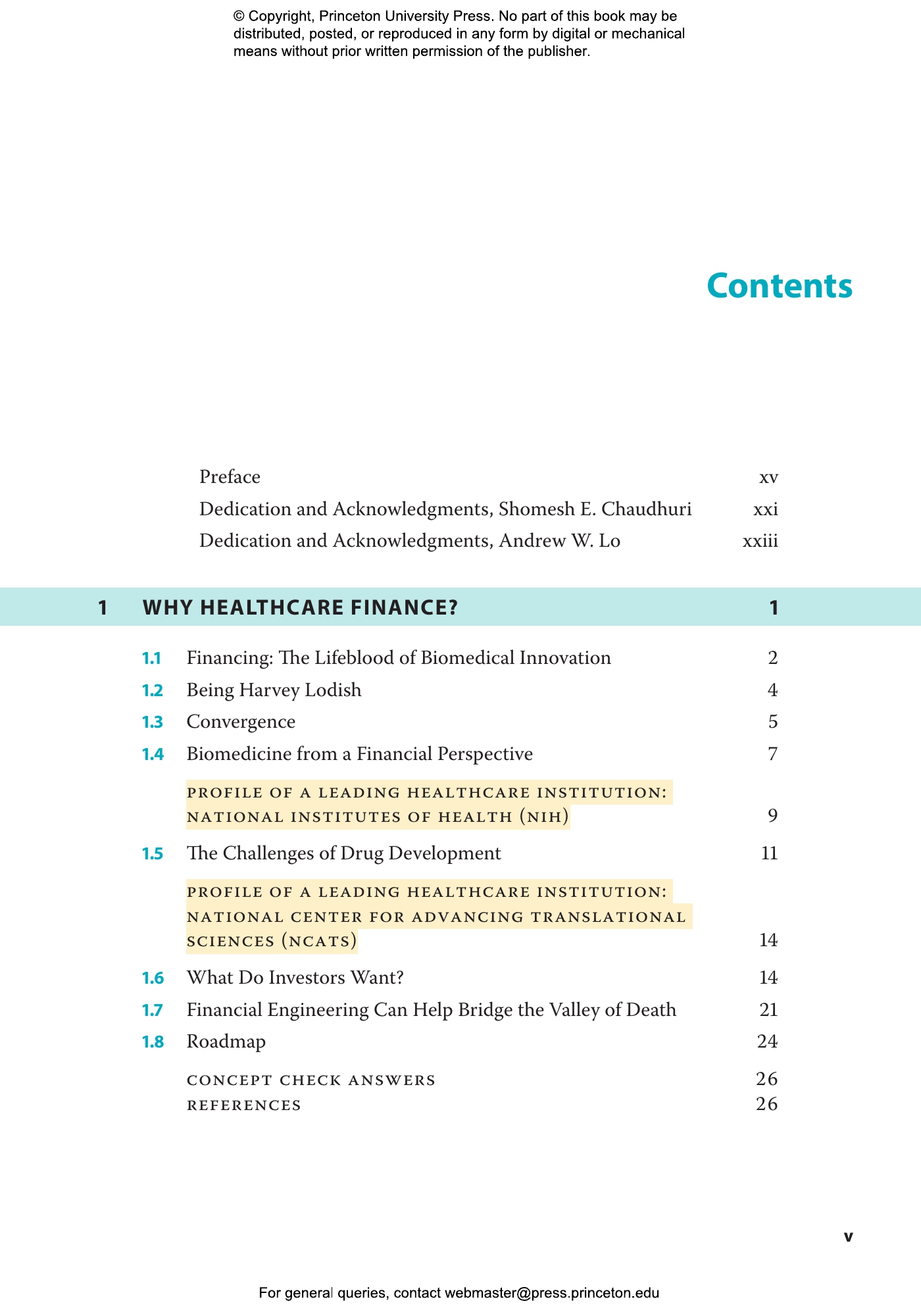

- Preface

- Dedication and Acknowledgments, Shomesh E. Chaudhuri

- Dedication and Acknowledgments, Andrew W. Lo

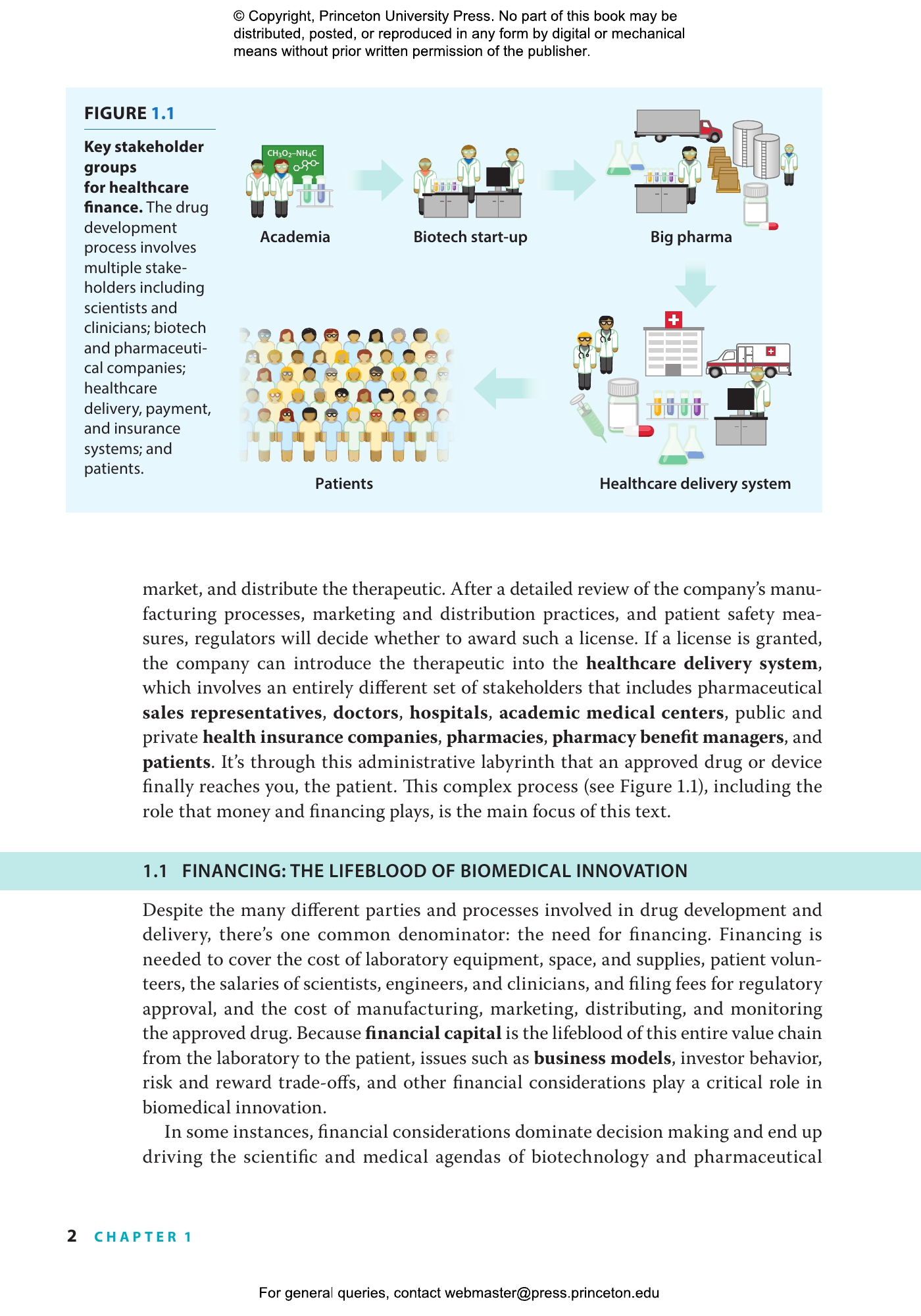

- 1 Why Healthcare Finance?

- 1.1 Financing: The Lifeblood of Biomedical Innovation

- 1.2 Being Harvey Lodish

- 1.3 Convergence

- 1.4 Biomedicine from a Financial Perspective

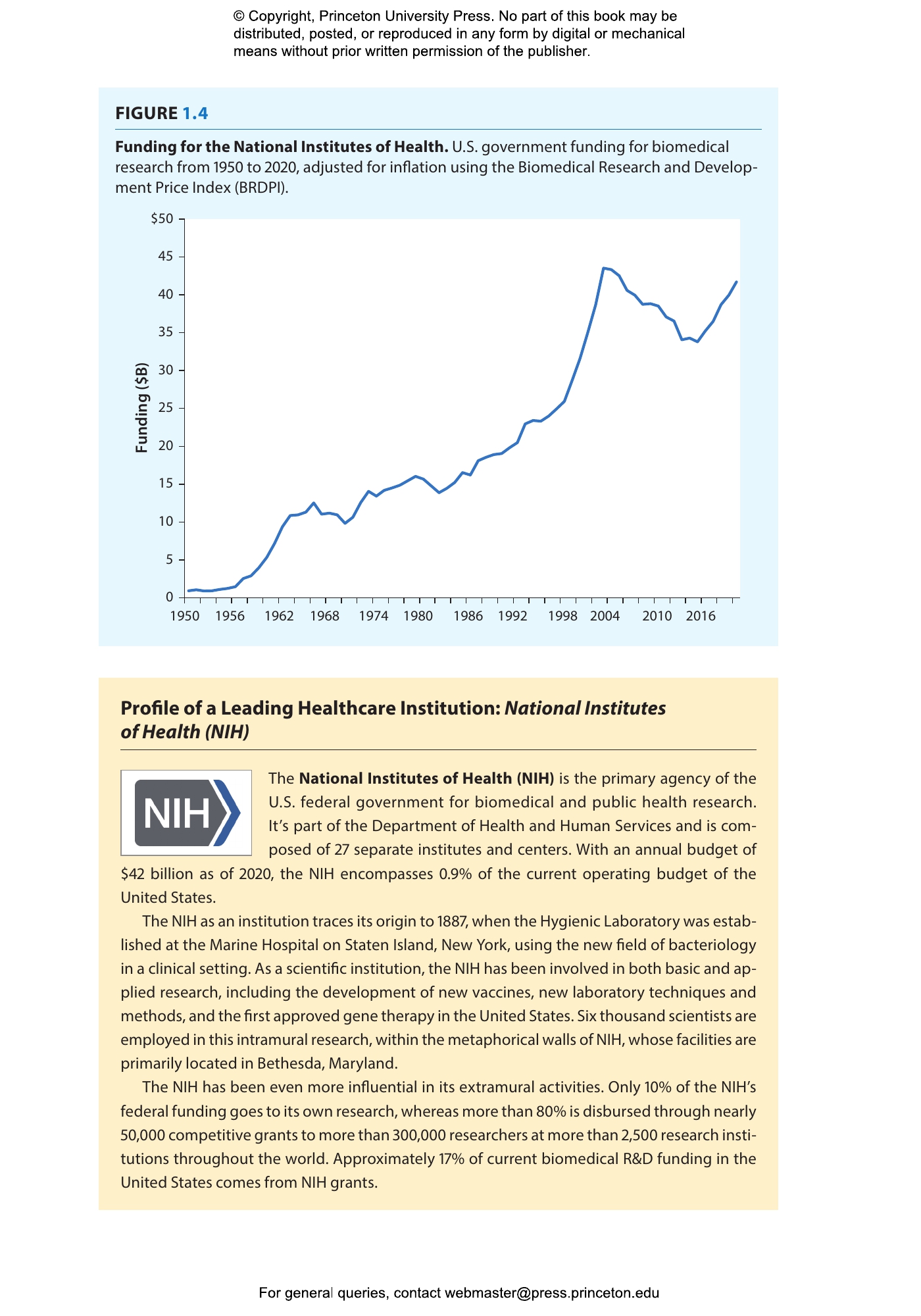

- PROFILE OF A LEADING HEALTHCARE INSTITUTION: NATIONAL INSTITUTES OF HEALTH (NIH)

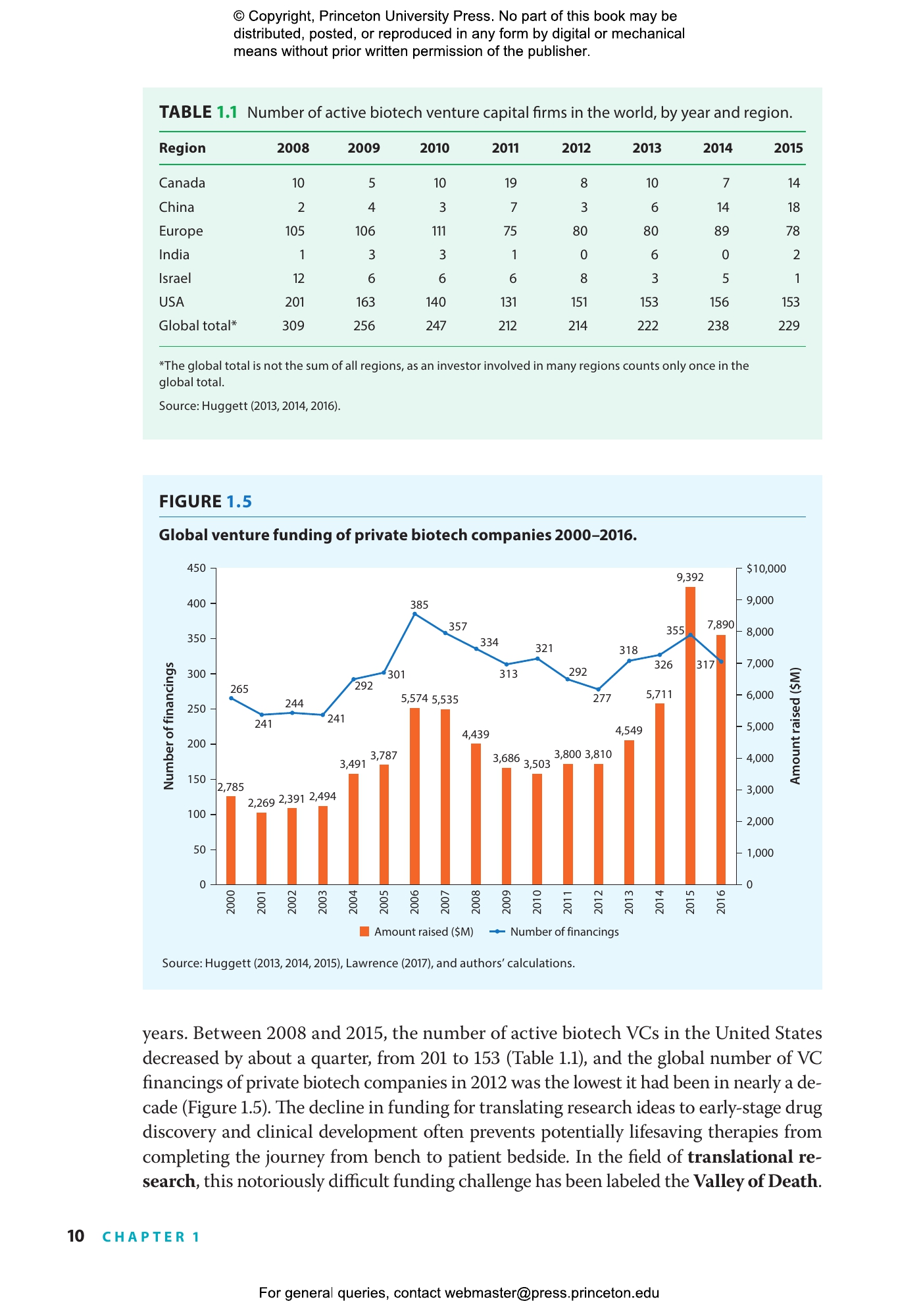

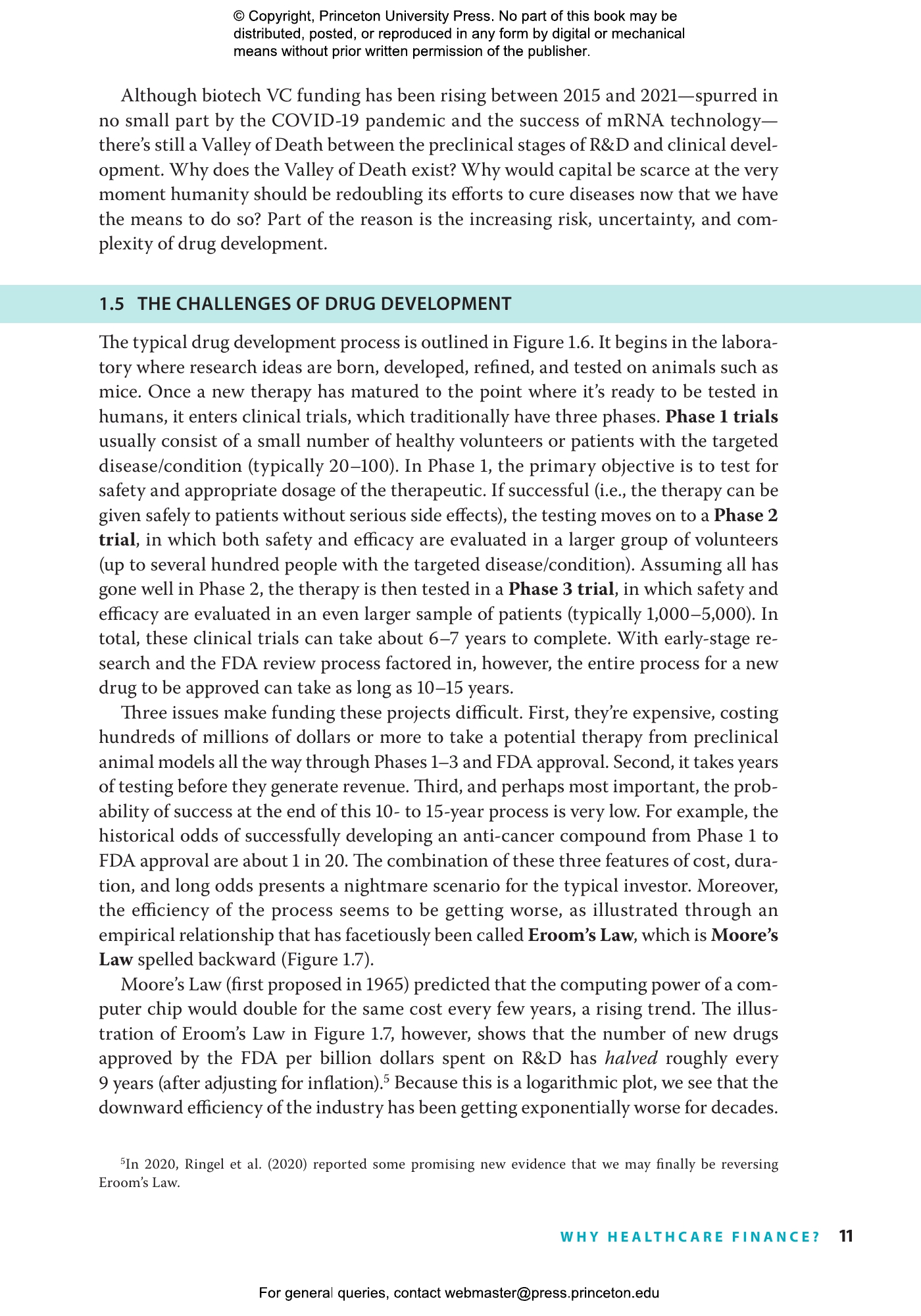

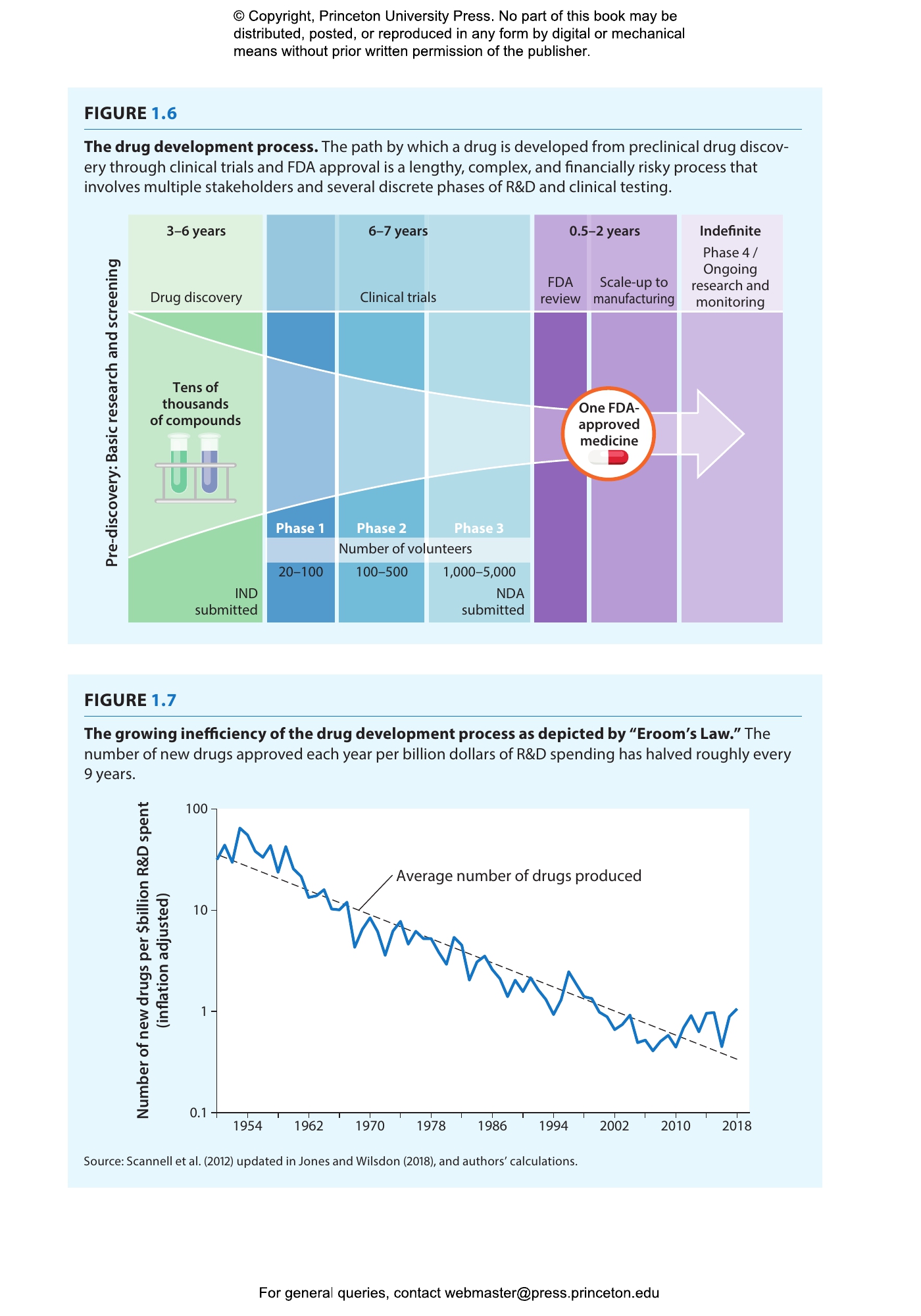

- 1.5 The Challenges of Drug Development

- PROFILE OF A LEADING HEALTHCARE INSTITUTION: NATIONAL CENTER FOR ADVANCING TRANSLATIONAL SCIENCES (NCATS)

- 1.6 What Do Investors Want?

- 1.7 Financial Engineering Can Help Bridge the Valley of Death

- 1.8 Roadmap

- CONCEPT CHECK ANSWERS

- REFERENCES

- 2 From the Laboratory to the Patient

- 2.1 Early-Stage Research and Development

- 2.2 Technology Licensing

- 2.3 Biotech Start-Up

- 2.4 The Role of Nonprofit Organizations

- 2.5 Later-Stage Clinical Development

- 2.6 The Growing Importance of Universities and Academic Medicine

- 2.7 Post-Approval Commercialization and Distribution

- 2.8 Patent Expiration, Generics, and Pricing

- 2.9 Commercial Health Insurers

- 2.10 Recent Trends in Industry Consolidation

- 2.11 Conclusion

- KEY POINTS

- REFERENCES

- 3 Present Value Relations

- 3.1 Assets as Sequences of Cash Flows

- 3.2 Assets and the Time Value of Money

- 3.3 Using Discount Rates to Determine an Asset’s Net Present Value

- 3.4 Future Value of a Current Cash Flow

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: DANA GOLDMAN

- 3.5 The Risk Premium

- 3.6 An Infinite Cash Flow: The Perpetuity Formula

- 3.7 A Finite Number of Fixed Cash Flows: The Annuity Formula

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: TOMAS J. PHILIPSON

- 3.8 Inflation

- 3.9 Inflation and Biomedicine

- 3.10 NPV versus Value versus Price

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET

- REFERENCES

- 4 Evaluating Business Opportunities

- 4.1 Valuing a Typical Biomedical Program

- 4.1a Probability of Success and Duration

- 4.1b Costs

- THE COST OF AN APPROVED DRUG

- 4.1c Revenues

- 4.1d Discounted Cash Flows and rNPV

- 4.2 Valuing a Typical Biopharma Company

- 4.2a Portfolio Constituents

- 4.2b Consolidated Financials

- 4.3 Deciding to Undertake or Shut Down a Project: The NPV Decision Rules

- 4.3a Use Cash Flows, Not Accounting Earnings, When Calculating NPV

- 4.3b Use After-Tax Cash Flows

- 4.3c Use Cash Flows on an Incremental Basis

- 4.4 Accounting Basics for Capital Budgeting

- 4.5 How to Use Accounting Data to Estimate Cash Flows

- 4.6 Other Capital Budgeting Techniques

- 4.6a Profitability Index

- 4.6b Payback Period

- 4.6c Internal Rate of Return

- 4.6d Industry Practices

- 4.7 Discounted Cash Flow Analysis of Artemis Biotherapeutics

- 4.7a Program Overview

- 4.7b Time Line and Probability of Transition Success (PoTS)

- 4.7c Program Revenues

- 4.7d Program Expenses

- 4.7e Discounted Cash Flow Analysis

- 4.8 Conclusion

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET

- REFERENCES

- 5 Valuing Bonds

- 5.1 Overview of Fixed-Income Markets

- 5.2 Valuing Discount Bonds and the Term Structure of Interest Rates

- 5.3 Forward Rates

- 5.4 Coupon Bonds

- 5.5 Yield to Maturity

- 5.6 Corporate Bonds

- 5.7 The Yield Spread: Sources of Risk

- 5.8 Bonds and Biopharma Companies

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET

- REFERENCES

- 6 Valuing Stocks

- 6.1 Legal Characteristics of Stocks

- 6.2 Stock Markets

- 6.3 Valuing Stocks Using the Dividend Discount Model

- 6.4 The Gordon Growth Model

- 6.5 The Multistage Valuation Model

- 6.6 Modeling Dividends via Payout Policy

- 6.7 Growth Opportunities

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET

- REFERENCES

- 7 Portfolio Management and the Cost of Capital

- 7.1 Measuring the Randomness of Returns

- 7.2 Portfolio Returns and Diversification

- 7.3 The Limits of Diversification

- 7.4 Estimating the Cost of Capital

- 7.5 Deriving the CAPM and Estimating Beta

- 7.6 The Weighted-Average Cost of Capital

- 7.7 The Cost of Capital in the Biopharma Industry

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: SCOTT E. HARRINGTON

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET

- REFERENCES

- 8 Therapeutic Development and Clinical Trials

- 8.1 Introduction to Pharmaceutical R&D

- 8.1a Drug Development

- PROFILE OF A LEADING HEALTHCARE INSTITUTION: FDA

- 8.1b Device Development

- 8.2 Clinical Trials by the Numbers

- PROFILE OF A LEADING BIOPHARMA PROFESSIONAL: RICHARD SCHELLER

- 8.3 Unique Challenges for Medical Devices

- 8.4 Randomized Clinical Trial Design

- 8.5 Size, Power, and Cost

- 8.6 Bayesian Adaptive Clinical Trials

- 8.7 Bayesian Decision Analysis and Patient Preferences

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET: THE STATISTICS OF CLINICAL TRIAL DESIGN

- REFERENCES

- 9 Decision Trees and Real Options

- 9.1 Overview of Decision Trees and Options

- PROFILE OF A LEADING BIOPHARMA PROFESSIONAL: JUDY C. LEWENT

- 9.2 Decision Tree Analysis

- 9.2a Constructing a Decision Tree

- 9.2b Decision Tree Analysis for Pharmaceutical R&D

- 9.3 Decision Trees and Optionality

- 9.3a Additional Options

- 9.3b Managing Complexity

- 9.4 Real Options and the Binomial Option-Pricing Model

- 9.5 Building a Binomial Tree

- 9.6 Incorporating Scientific Risk

- 9.7 The Binomial Option-Pricing Model

- 9.7a The Two-Period Binomial Option-Pricing Model

- 9.7b The Multiperiod Binomial Option-Pricing Model

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET: abc pharmaceuticals case study

- REFERENCES

- 10 Monte Carlo Simulation

- 10.1 Why Simulate?

- 10.2 Applications of Monte Carlo Simulation

- KEY POINTS

- CONCEPT CHECK ANSWERS

- 11 Healthcare Analytics

- 11.1 Estimating Clinical Trial Success Rates

- PROFILE OF A LEADING HEALTHCARE INSTITUTION: TUFTS CENTER FOR THE STUDY OF DRUG DEVELOPMENT (TUFTS CSDD)

- 11.2 Predicting Drug Approvals

- 11.3 Machine-Learning Predictions of Probabilities of Success

- 11.4 Modeling Correlation

- 11.4a Correlation via Latent Variables

- 11.4b Estimating Correlations via Subjective Judgment

- 11.5 Simulating Correlated Random Variables

- 11.6 Conclusion

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: HEIDI WILLIAMS

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET: machine-learning models for predicting drug approvals

- REFERENCES

- 12 Biotech Venture Capital

- PROFILE OF A LEADING SCIENTIST/ENTREPRENEUR: PHILLIP SHARP

- 12.1 What Is Venture Capital?

- PROFILE OF A LEADING SCIENTIST/ENTREPRENEUR: ROBERT S. LANGER

- PROFILE OF A LEADING SCIENTIST/ENTREPRENEUR: TILLMAN GERNGROSS

- 12.2 Mitigating Risks and Aligning Goals: The Term Sheet

- 12.2a Commitment of Capital

- 12.2b Types of Securities

- 12.2c Covenants

- 12.2d Registration Rights

- PROFILES OF LEADING BIOPHARMA PROFESSIONALS: LUKE EVNIN AND ANSBERT GADICKE

- 12.3 Raising Start-Up Capital

- PROFILE OF A LEADING BIOPHARMA PROFESSIONAL: BRUCE BOOTH

- 12.4 Biotech Valuation

- 12.4a Determining Value Out: Revenues

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: MICHAEL GROSSMAN

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: JOSEPH A. DIMASI

- 12.4b Determining Money In: Expenses

- 12.4c Investment Time Horizon

- Valuing Therapies for Rare Diseases

- 12.4d Biotech Valuation Summary

- 12.5 Venture Philanthropy

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: CAM DONALDSON

- The Cystic Fibrosis Foundation and Venture Philanthropy

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET: axon bio case study

- REFERENCES

- 13 Securitizing Biomedical Assets

- 13.1 What Is Securitization?

- 13.2 A Numerical Example of Securitization

- 13.3 Securitization and the Financial Crisis of 2007–2008

- 13.3a Numerical Example of Securitization Gone Wrong

- 13.4 Biomedical Megafunds

- PROFILE OF A LEADING BIOPHARMA PROFESSIONAL: CHRISTIANA GOH BARDON

- PROFILE OF A LEADING BIOPHARMA PROFESSIONAL: NEIL KUMAR

- 13.5 When Megafunds Don’t Work

- 13.6 Conclusion

- KEY POINTS

- CONCEPT CHECK ANSWERS

- PROBLEM SET: orphan drug portfolio analysis

- REFERENCES

- 14 Pricing, Value, and Ethics

- 14.1 Price versus Value

- 14.2 Ethics

- 14.3 Evaluating Cost Effectiveness

- PROFILE OF A LEADING HEALTHCARE INSTITUTION: NATIONAL INSTITUTE FOR HEALTH AND CARE EXCELLENCE (NICE)

- 14.4 Financing Health

- 14.5 Can We Afford It?

- PROFILE OF A LEADING HEALTHCARE INSTITUTION: INSTITUTE FOR CLINICAL AND ECONOMIC REVIEW (ICER)

- 14.6 Pricing Issues

- 14.6a Drug Shortages

- 14.6b Medical Device Shortages

- 14.6c Drug Shortages Task Force

- 14.7 Drug Manufacturer as Utility Company?

- PROFILE OF A LEADING HEALTHCARE POLICY EXPERT: PETER B. BACH

- 14.8 Price Gouging versus Pricing for Survival

- PROFILE OF A LEADING HEALTHCARE ECONOMIST: KENNETH J. ARROW

- KEY POINTS

- CONCEPT CHECK ANSWERS

- REFERENCES

- 15 Epilogue: A Case Study of Royalty Pharma

- PROFILE OF A LEADING BIOPHARMA PROFESSIONAL: PABLO LEGORRETA

“A crystal-clear—and fascinating—book. It should be of interest to those teaching health economics or healthcare economics, and to anyone who wants to better understand how healthcare finance works.”—Emily Oster, author of The Family Firm: A Data-Driven Guide to Better Decision Making in the Early School Years

“Developing treatments to cure diseases is expensive. It is also risky, as knowledge of human physiology remains incomplete. This unique and readable textbook provides a framework for considering investments in this critical space.”—Phillip A. Sharp, winner of Nobel Prize in Physiology or Medicine

“Lo and Chaudhuri have written the most important book for navigating the financial innovations required to turn today’s rapid advances in biology and medicine into new therapies that will change the practice of healthcare. From basic tools to the most advanced and creative financial concepts, Healthcare Finance is must-read for students and professionals alike.”—Terry McGuire, founder of Polaris Partners and former chair of the National Venture Capital Association

“Andrew Lo and Shomesh Chaudhuri are pioneers in healthcare finance and this is a must-read for business students, scientists, engineers, and physicians who want to translate their ideas into practice and are looking for optimal ways of financing them.”—Robert Langer, Massachusetts Institute of Technology

“Which new medical discoveries successfully transition from the scientific lab to actually helping patients depends—in large part—on a complicated web of business models and decisions. This book provides a lucid and accessible introduction to the landscape of healthcare finance.”—Heidi Williams, Stanford University