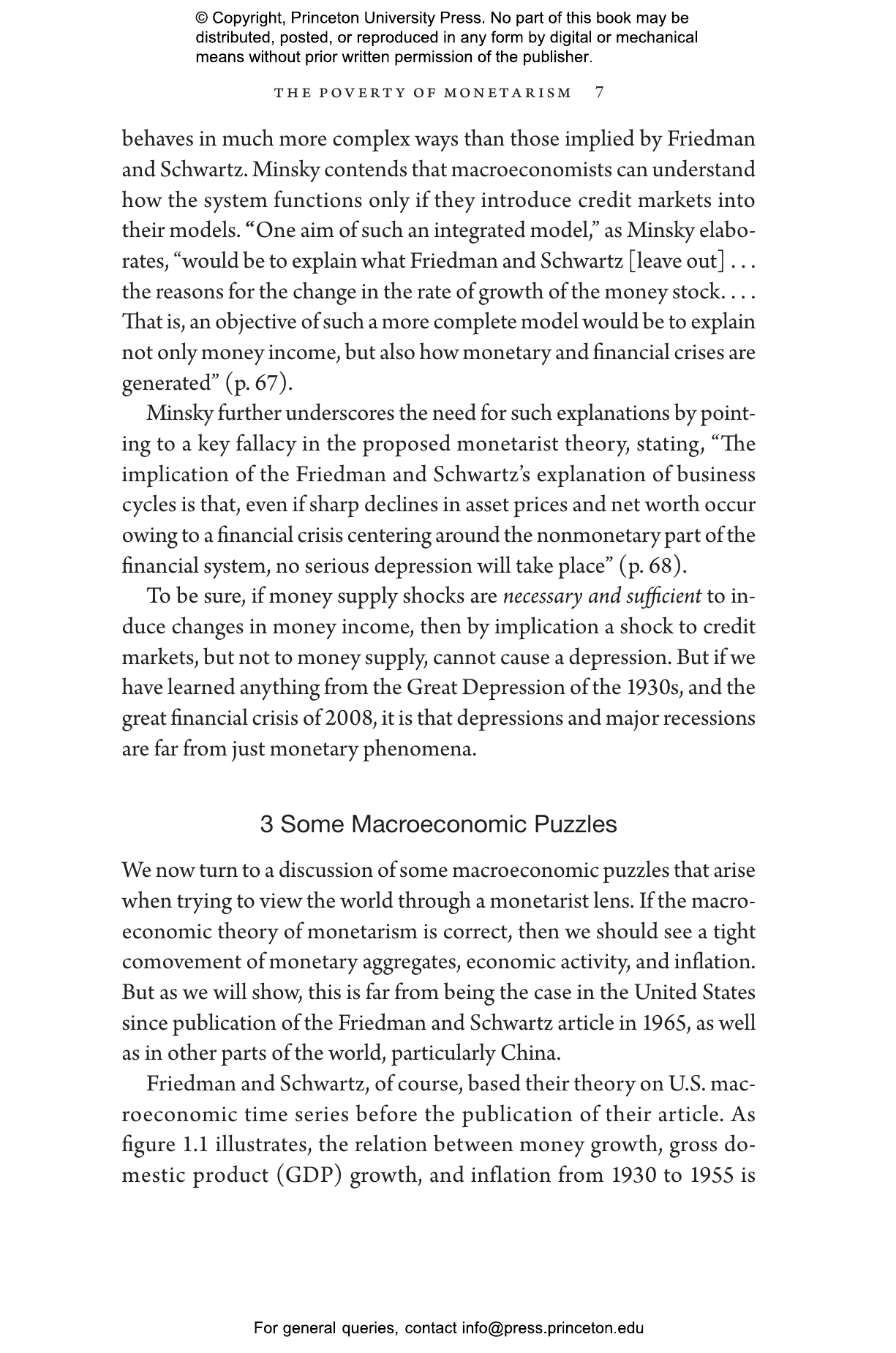

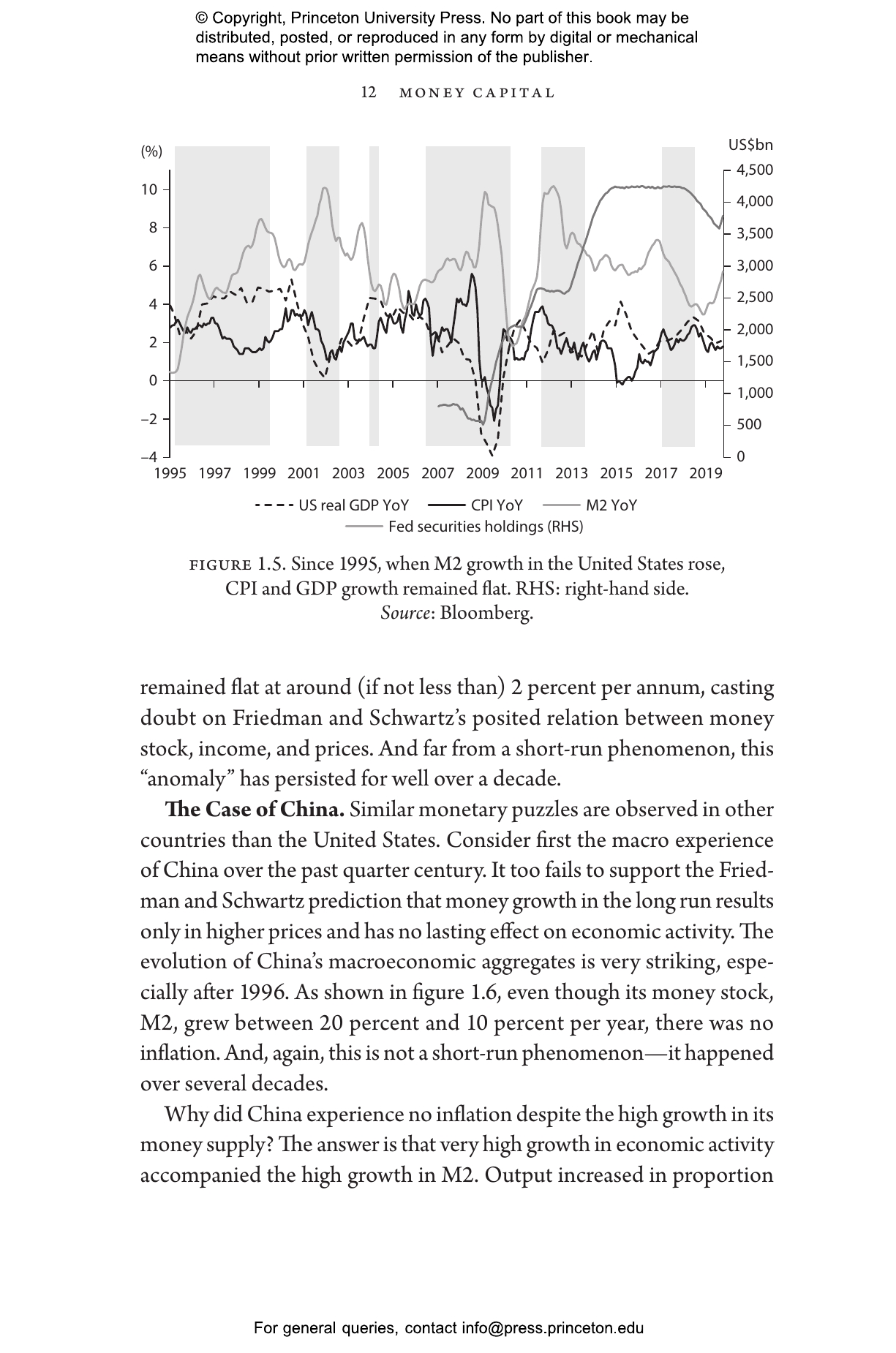

A conventional economic theory, monetarism, holds that inflation is a monetary phenomenon driven by changes in the supply of money. Yet recent experience—including the aftermath of the financial crisis of 2008 and the economic development of China—contradict this basic prediction. In this book, leading economists Patrick Bolton and Haizhou Huang offer a novel perspective, viewing monetary economics through the lens of corporate finance. They propose a richer theory, where money can be seen as the equity capital of a nation, playing a similar role as stocks for a company. This innovative framework integrates the real and monetary sides of the economy, with a banking sector and debt at its core.

In the financial world, companies issue new shares only if it results in some kind of value creation; this is a basic principle of corporate finance that Bolton and Huang argue can be applied to monetary economics. When the government increases the money supply to finance positive net value investments—when it prints money to keep the economy going—it increases output, not inflation. This is evidenced by the strong growth in GDP and money in China over the last four decades, and in the United States during World War II. The effect of increasing money supply, they argue, depends on how money enters the system and what the money buys. The principles outlined by Bolton and Huang shed new light on a range of issues, including inflation, monetary and fiscal policy, central banking, money and growth, and the international monetary system.

Patrick Bolton is professor of finance at Imperial College London and senior advisor to the Lazard Climate Center. Past president of the American Finance Association and a fellow of the Econometric Society, he is the coauthor of Contract Theory and The Green Swan: Central Banking and Financial Stability in the Age of Climate Change. Haizhou Huang Haizhou Huang is Special-Term Professor of Finance at PBoC School of Finance and Shanghai Advanced Institute of Finance and external member of the Monetary Policy Committee at the People's Bank of China (China's Central Bank). He is the author of The Global Financial System: Crises and Reforms and the coeditor of The Changing Fortunes of Central Banking.

"Highly recommended."—Choice

“This book is a marvelous invitation to rethink deeply what we thought we knew about monetary economics and international finance. It leads us down unexplored paths. Fiat money could be thought of as equity of a nation. This has powerful implications which the book spells out in the most clear and elegant way: the optimal money supply becomes an investment decision and the Bagehot rule becomes inadvisable for central banks. I enthusiastically recommend this highly creative book. Reading it makes us see the world and economic theories through new lenses.”—Hélène Rey, London Business School

“Money is a nation's equity, sovereignty and central banking. Money Capital provides profoundly new perspectives for monetary policy, international finance, investment, and development finance. Bolton and Huang seek to trace the development of such new insights and identify their enlightening implications, and their book serves as a guidance for policy making, investing, and development financing.” —Chen Yuan, former Chairman of China Development Bank

“In Money Capital, Bolton and Huang build an entirely new framework to study money, banking, central banking, and international finance. Their innovative insight of money being the equity of a nation leads to fascinating new perspectives on many important theoretical and policy issues, including how money should enter the economy, what is the optimal amount of money growth to support economic prosperity, how to conduct the lender-of-last-resort operations, how to coordinate monetary and fiscal policy, and how to form an optimal currency area. I strongly recommend this enlightening book to all policymakers, academics, financial professionals, and the general public interested in these issues.”—Yu Yongding, Chinese Academy of Social Sciences, and former President of China’s World Economic Society

“The essence of this excellent book it is that fiat money has important attributes in common with corporate equity—its value rises and falls in proportion with the strength of the issuer. On this and other often disputed cases, such as large expenditures and optimal currency areas and monetary unions, the authors are correct, which makes this book important for all those interested in monetary issues to read and learn.”—Charles Goodhart, London School of Economics