With more than half of today’s global GDP being produced by approximately four hundred metropolitan centers, learning about the economics of cities is vital to understanding economic prosperity. This textbook introduces graduate and upper-division undergraduate students to the field of urban economics and fiscal policy, relying on a modern approach that integrates theoretical and empirical analysis. Based on material that Holger Sieg has taught at the University of Pennsylvania, Urban Economics and Fiscal Policy brings the most recent insights from the field into the classroom.

Divided into short chapters, the book explores fiscal policies that directly shape economic issues in cities, such as city taxes, the provision of quality education, access to affordable housing, and protection from crime and natural hazards. For each issue, Sieg offers questions, facts, and background; illuminates how economic theory helps students engage with topics; and presents empirical data that shows how economic ideas play out in daily life. Throughout, the book pushes readers to think critically and immediately put what they are learning to use by applying cutting-edge theory to data.

A much-needed resource for students and policymakers, Urban Economics and Fiscal Policy offers a unique approach to a vital and fast-growing area of economic study.

- Introduces advanced-undergraduate and graduate students to urban economics

- Presents the latest theoretical and empirical research

- Applies economic tools to real-world issues, including housing, labor, education, crime, and the environment

- Explains and uses simple economic models and quantitative analysis

Holger Sieg is the J. M. Cohen Term Professor of Economics at the University of Pennsylvania. He is also a research associate at the National Bureau of Economic Research.

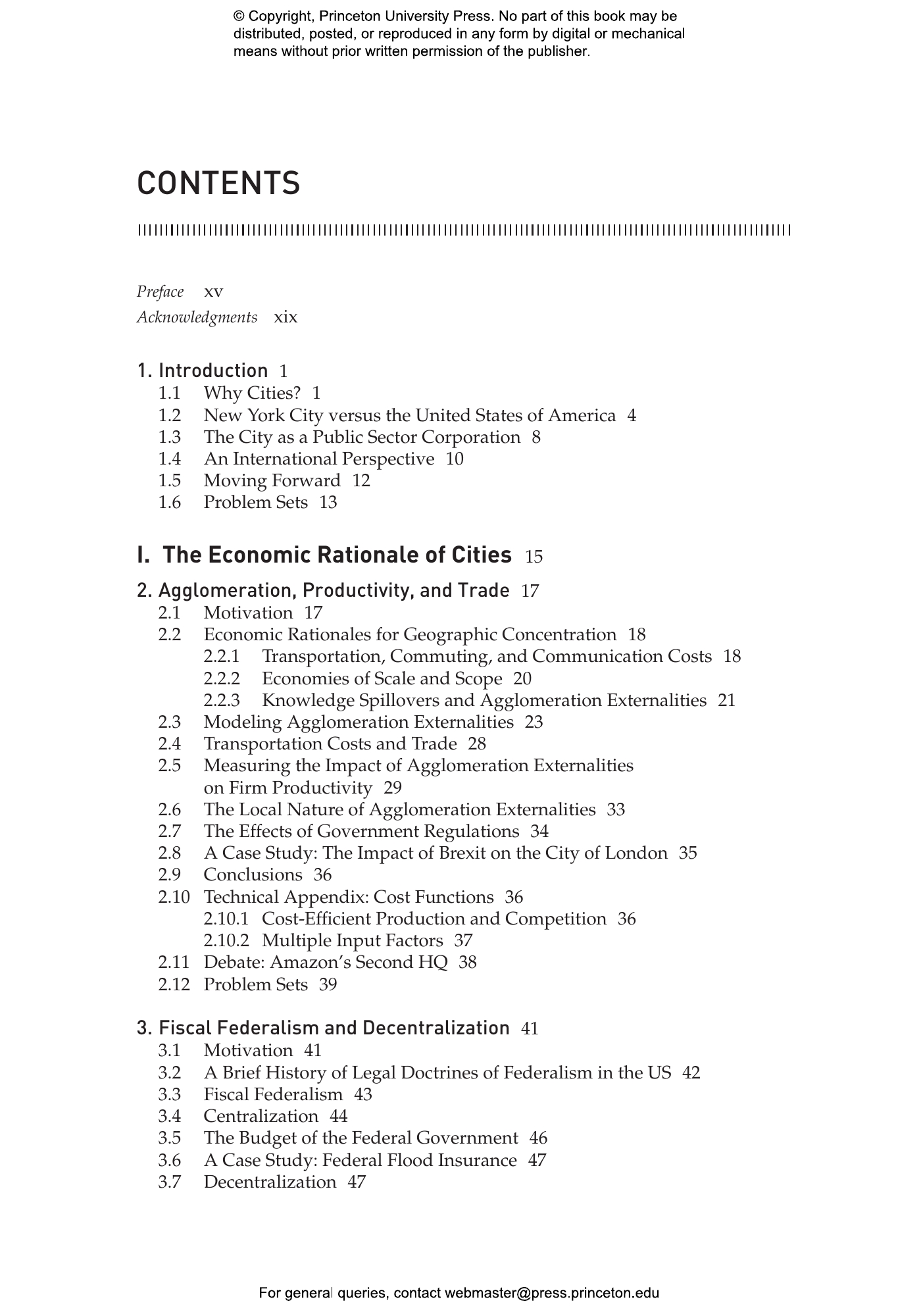

- Preface

- Acknowledgments

- 1. Introduction

- 1.1 Why Cities?

- 1.2 New York City versus the United States of America

- 1.3 The City as a Public Sector Corporation

- 1.4 An International Perspective

- 1.5 Moving Forward

- 1.6 Problem Sets

- I. The Economic Rationale of Cities

- 2. Agglomeration, Productivity, and Trade

- 2.1 Motivation

- 2.2 Economic Rationales for Geographic Concentration

- 2.2.1 Transportation, Commuting, and Communication Costs

- 2.2.2 Economies of Scale and Scope

- 2.2.3 Knowledge Spillovers and Agglomeration Externalities

- 2.3 Modeling Agglomeration Externalities

- 2.4 Transportation Costs and Trade

- 2.5 Measuring the Impact of Agglomeration Externalities on Firm Productivity

- 2.6 The Local Nature of Agglomeration Externalities

- 2.7 The Effects of Government Regulations

- 2.8 A Case Study: The Impact of Brexit on the City of London

- 2.9 Conclusions

- 2.10 Technical Appendix: Cost Functions

- 2.10.1 Cost-Efficient Production and Competition

- 2.10.2 Multiple Input Factors

- 2.11 Debate: Amazon’s Second HQ

- 2.12 Problem Sets

- 3. Fiscal Federalism and Decentralization

- 3.1 Motivation

- 3.2 A Brief History of Legal Doctrines of Federalism in the US

- 3.3 Fiscal Federalism

- 3.4 Centralization

- 3.5 The Budget of the Federal Government

- 3.6 A Case Study: Federal Flood Insurance

- 3.7 Decentralization

- 3.8 Heterogeneity in Preferences over Policies

- 3.8.1 Testing the Central Tenet of Economic Federalism

- 3.8.2 Heterogeneity in Education Policies among US States

- 3.8.3 Heterogeneity in Fiscal Policies among the Largest US Cities

- 3.9 Social Learning and Experimentation

- 3.10 A Case Study: Special Economic Zones

- 3.11 Conclusions

- 3.12 Technical Appendix: Deriving Optimal Policies

- 3.13 Debate: Flood Insurance

- 3.14 Problem Sets

- II. Efficient and Voluntary Provision of Public Goods in Cities

- 4. Efficient Provision of Local Public Goods and Services

- 4.1 Motivation

- 4.2 Efficient Public Good Provision

- 4.2.1 Defining Local Public Goods

- 4.2.2 Pure Public Goods

- 4.2.3 Congestion

- 4.3 Implementation and Mechanism Design

- 4.3.1 The Lindahl Mechanism

- 4.3.2 The Vickrey-Clarke-Groves Mechanism

- 4.4 Stated Preferences over Public Good Provision

- 4.5 Practical Implementation: Optimal Class Size

- 4.6 A Case Study: Berlin Brandenburg Airport

- 4.7 Conclusions

- 4.8 Technical Appendix A: Deriving the Optimality Conditions for the Baseline Model

- 4.9 Technical Appendix B: Deriving the Optimality Conditions for the Model with Congestion

- 4.10 Technical Appendix C: Applying the VCG Mechanism

- 4.10.1 The Planner’s Problem

- 4.10.2 Side Payments

- 4.10.3 Taxes

- 4.10.4 Incentives to Tell the Truth

- 4.11 Debate: Efficient Cities

- 4.12 Problem Sets

- 5. Voluntary Provision of Local Public Goods and Services

- 5.1 Motivation

- 5.2 A Model of Voluntary Provision of Public Goods

- 5.3 Empirical Evidence of Crowd-Out

- 5.4 Warm Glow and Private Benefits

- 5.5 Empirical Evidence: Private Benefits versus Warm Glow

- 5.6 Tax Incentives and Matching

- 5.7 Conclusions

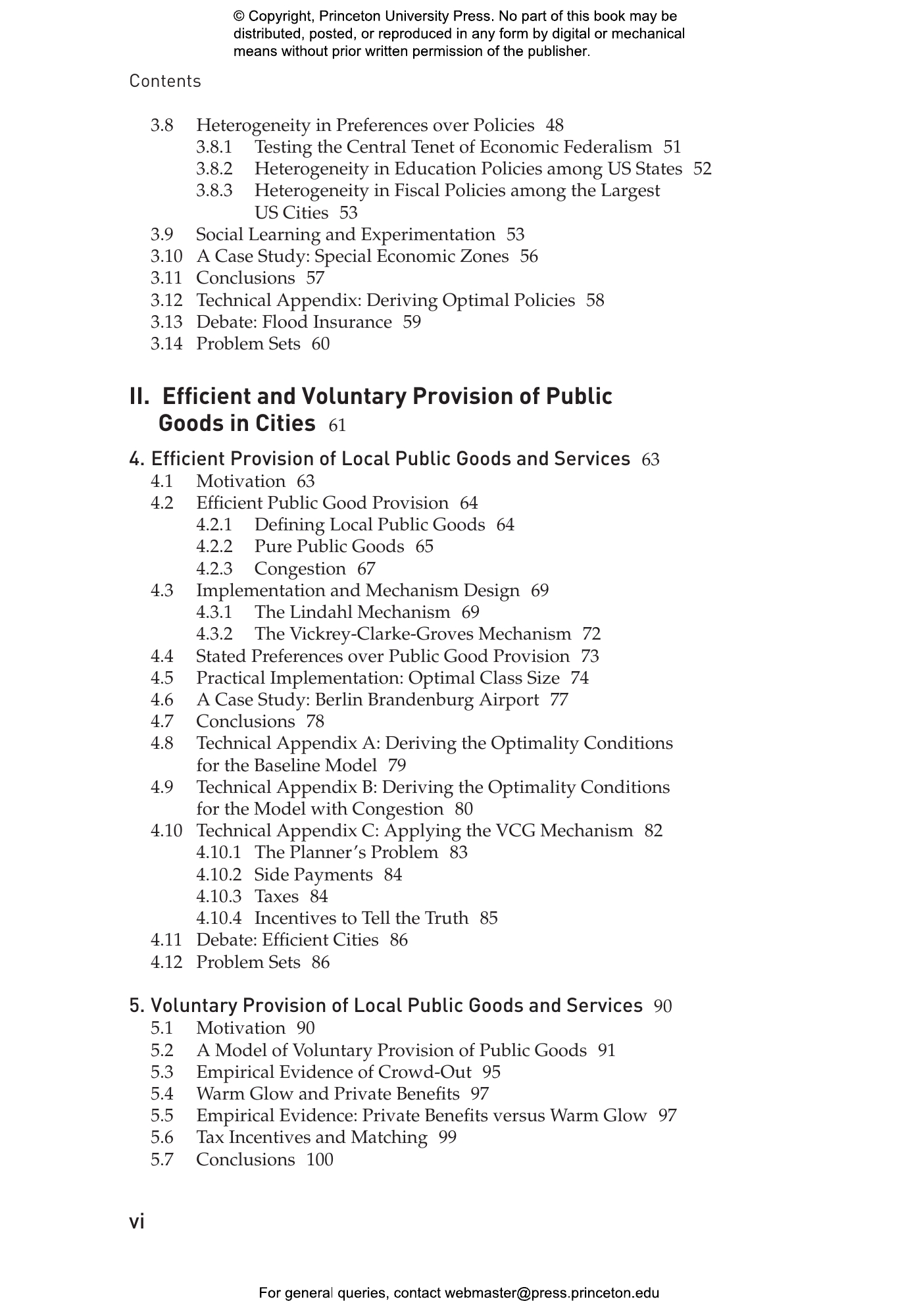

- 5.8 Technical Appendix: Deriving the Nash Equilibrium

- 5.9 Debate: Tax Deductibility of Charitable Donations

- 5.10 Problem Sets

- III. Political Economy of State and Local Governments

- 6. Local Political Institutions in the US

- 6.1 Motivation

- 6.2 A Brief History of Local Governments in the US

- 6.3 Characterizing Municipal Governments in the US

- 6.4 Legal Foundations of Municipal Governments

- 6.5 Direct Democracy

- 6.5.1 Initiative, Referendum, and Recall

- 6.5.2 A Case Study: Fracking in Athens, Ohio

- 6.6 Representative Democracy

- 6.6.1 Local Forms of Government

- 6.6.2 Partisan versus Nonpartisan Elections

- 6.6.3 A Case Study: Electoral Reform in Asheville, NC

- 6.6.4 Term Limits

- 6.7 Conclusions

- 6.8 Debate: Mayor-Council versus Council-Manager

- 6.9 Problem Sets

- 7. Voting over Local Public Good Provision

- 7.1 Motivation

- 7.2 Majority Rule in a Direct Democracy

- 7.2.1 The Median Voter Theorem

- 7.2.2 Sequential Voting

- 7.2.3 Vote Buying, Vote Trading, and Log Rolling

- 7.3 Representative Democracy

- 7.4 Is the Median-Income Voter Decisive? Empirical Evidence

- 7.5 Discussion

- 7.5.1 Dimensionality of the Policy Space

- 7.5.2 Ideology and Competence

- 7.5.3 Accountability and Competence

- 7.5.4 Voter Turnout

- 7.6 A Case Study: The Role of Money in State and Local Politics

- 7.7 Conclusions

- 7.8 Technical Appendix: The Public Good Provision Problem

- 7.9 Debate: City Politics

- 7.10 Problem Sets

- 8. Household Mobility and Fiscal Competition

- 8.1 Motivation

- 8.2 Sorting and Competition among Municipalities

- 8.3 Capitalization: Empirical Evidence

- 8.4 Competition and Efficiency: Empirical Evidence

- 8.5 A Case Study: The Benefits of Consolidation

- 8.6 Income Stratification and Voting

- 8.7 Segregation and Sorting by Race

- 8.8 Conclusions

- 8.9 Technical Appendix: Optimal Locational Choices

- 8.9.1 Modeling Fiscal Competition

- 8.9.2 Imperfect Sorting by Income

- 8.10 Debate: City-County Merger

- 8.11 Problem Sets

- 9. Spillovers, Fiscal Inequality, and Intergovernmental Transfers

- 9.1 Motivation

- 9.2 Heterogeneity in Intergovernmental Transfers among the Largest US Cities

- 9.3 Fiscal Spillover Effects

- 9.4 Inequality and Fairness

- 9.5 Different Types of Intergovernmental Grants

- 9.6 Poverty and Intergovernmental Transfers

- 9.7 Conclusions

- 9.8 Technical Appendix: Solving the Model with Spillovers

- 9.9 Debate: School Finance Equalization Laws

- 9.10 Problem Sets

- 10. Rent-Seeking Behavior

- 10.1 Motivation

- 10.2 Modeling Rent-Seeking Behavior

- 10.3 Empirical Evidence

- 10.3.1 State Bond Ratings

- 10.3.2 Corruption and Accountability: Evidence from Brazil

- 10.4 A Case Study: Procurement Auctions in Puerto Rico

- 10.5 Conclusions

- 10.6 Technical Appendix: Computing the Equilibrium of the All-Pay Auction

- 10.7 Debate: Term Limits

- 10.8 Problem Sets

- 11. Labor Relations and Collective Bargaining

- 11.1 Motivation

- 11.2 Employer and Union Rights and Obligations

- 11.3 The Theory of Bargaining and Negotiations

- 11.3.1 A Bargaining Model

- 11.3.2 Employment and Wage Negotiations

- 11.3.3 Discussion

- 11.4 Components of Municipal Labor Policy

- 11.4.1 Wages and Salaries

- 11.4.2 Employment and Work Rules

- 11.4.3 Benefits and Pension Funding

- 11.5 Funding of Pension Plans

- 11.6 A Case Study: Collective Bargaining in Philadelphia

- 11.7 Conclusions

- 11.8 Technical Appendix: A Bargaining Model

- 11.9 Debate: Pay-as-You-Go

- 11.10 Problem Sets

- IV. The Determination of City Taxes

- 12. Property Taxation

- 12.1 Motivation

- 12.2 Justifications of the Property Tax

- 12.2.1 The Property Tax as a Benefit Tax

- 12.2.2 The Property Tax as a Tax on Capital

- 12.2.3 The Impact of Property Taxes on Renters

- 12.2.4 Fairness

- 12.2.5 Other Administrative Advantages

- 12.3 Property Tax Compliance

- 12.3.1 Some Evidence

- 12.3.2 Modeling Property Tax Compliance Behavior

- 12.3.3 The Effectiveness of Nudge Strategies

- 12.4 Property Tax Limitations and Commercial Property Tax Exemptions

- 12.5 Alternatives to the Property Tax

- 12.5.1 Is a Land Tax a Better Alternative?

- 12.5.2 A Case Study: The Soda Tax in Philadelphia

- 12.6 Conclusions

- 12.7 Debate: Property versus Income Taxation

- 12.8 Problem Sets

- 13. Business Taxation and Economic Development

- 13.1 Motivation

- 13.2 Empirical Evidence on Firm Sorting

- 13.3 A Model of Firm Location Choices

- 13.4 Tax Policy and Firm Location

- 13.5 Business Taxation in Practice

- 13.6 Tax Increment Financing and Community Development

- 13.7 A Case Study: The Relocation of UBS

- 13.8 Conclusions

- 13.9 Technical Appendix: The Derivation of the Profit Function

- 13.10 Debate: Reforming Business Taxation

- 13.11 Problem Sets

- V. The Practice of Urban Fiscal Policies

- 14. Municipal Budgeting and Planning

- 14.1 Motivation

- 14.2 Priorities and Mission Statement

- 14.3 Operating Budget

- 14.3.1 Revenues

- 14.3.2 Expenses

- 14.3.3 Flexible Budgets

- 14.4 Capital Budget

- 14.5 Forecasting

- 14.5.1 Revenue Forecasting

- 14.5.2 Cost and Expenditure Forecasting

- 14.6 Benefit-Cost Analysis

- 14.7 Conclusions

- 14.8 Debate: Hosting the Super Bowl

- 14.9 Problem Sets

- 15. Fiscal Policies and Fiscal Crisis

- 15.1 Motivation

- 15.2 Data

- 15.3 Expenditure Policies

- 15.4 Revenue Policies

- 15.5 Common Policy Mistakes

- 15.5.1 Labor Policies

- 15.5.2 Redistribution and Tax Policies

- 15.5.3 Economic Development Policies

- 15.6 Municipal Bankruptcies

- 15.7 A Case Study: The Detroit Bankruptcy

- 15.8 A Case Study: The Fiscal Crisis and Recovery of Pittsburgh

- 15.9 Conclusions

- 15.10 Debate: Fiscal Policies in NYC under Mayor de Blasio

- 15.11 Problem Sets

- 16. Debt Finance and Municipal Bond Markets

- 16.1 Motivation

- 16.2 Key Players in the Municipal Bond Markets

- 16.3 Bond Characteristics

- 16.4 New York City’s Participation in Municipal Bond Markets

- 16.4.1 Data

- 16.4.2 Volume and Amount Issued over Time

- 16.4.3 Municipal Bond Ratings over Time

- 16.5 A Case Study: Build America Bonds

- 16.6 Conclusions

- 16.7 Debate: Tax Exemption of Municipal Bonds

- 16.8 Problem Sets

- VI. Managing Urban Challenges

- 17. Urban Poverty

- 17.1 Motivation

- 17.2 Defining Poverty

- 17.3 Differences in Poverty by Race

- 17.4 Human Capital and Poverty

- 17.5 How Do Welfare Programs Change the Budget Set?

- 17.6 The Adverse Incentive Effects of Welfare Programs

- 17.7 Reforming Welfare Programs

- 17.7.1 Work Incentives

- 17.7.2 Welfare Limits and TANF

- 17.7.3 Extending the Earned Income Tax Credit

- 17.7.4 Work Requirements for Public Housing

- 17.8 Discrimination and Affirmative Action Programs

- 17.9 Place-Based Policies

- 17.10 Conclusions

- 17.11 Technical Appendix: Incentive Effects

- 17.12 Debate: Time Limits and Work Requirements

- 17.13 Problem Sets

- 18. The Provision of Education in Urban School Districts

- 18.1 Motivation

- 18.2 Some Facts about Urban School Districts

- 18.3 Education as Human Capital Investment

- 18.4 How Large Are the Returns to Human Capital?

- 18.5 Public Provision of Primary and Secondary Education

- 18.6 Two Case Studies: Philadelphia and Pittsburgh

- 18.7 Early Childhood Education

- 18.8 Reforming Urban Primary and Secondary Schools

- 18.8.1 Accountability and No Child Left Behind

- 18.8.2 Classroom Size Reductions

- 18.8.3 Magnet Schools

- 18.8.4 Charter Schools

- 18.8.5 Teacher Quality and Compensation

- 18.8.6 Vouchers and Private Schools

- 18.9 Conclusions

- 18.10 Debate: Pay for Performance for Teachers

- 18.11 Problem Sets

- 19. Crime and Public Safety

- 19.1 Motivation

- 19.2 An Economic Model of Crime

- 19.3 Policy Implications

- 19.4 The Economics of Organized Crime

- 19.5 Police Effectiveness

- 19.6 The Demand for Addictive Goods

- 19.7 A Case Study: The Prohibition Experience

- 19.8 Decriminalization of “Soft” Drugs

- 19.9 Conclusions

- 19.10 Technical Appendix: Optimal Gang Size

- 19.11 Debate: Legalizing Marijuana

- 19.12 Problem Sets

- 20. Urban Environmental Challenges

- 20.1 Motivation

- 20.2 Negative Production Externalities

- 20.3 Empirical Evidence on Measuring the Negative Effects of Air Pollution

- 20.4 Heterogeneity in Abatement Costs

- 20.5 A Case Study: The Clean Air Act

- 20.6 Regulation under Uncertainty

- 20.7 A Case Study: The Flint Water Crisis

- 20.8 The Impact of Global Warming on Cities

- 20.9 A Case Study: Redesigning Flood Zones in NYC

- 20.10 A Case Study: Rebuilding New Orleans after Hurricane Katrina

- 20.11 Conclusions

- 20.12 Technical Appendix: Solving the Model of Externalities

- 20.13 Debate: Lessons from Flint

- 20.14 Problem Sets

- 21. Managing Cities in Developing Countries

- 21.1 Motivation

- 21.2 The Origins of Power, Prosperity, and Poverty

- 21.3 Trust and Making Credible Commitments

- 21.4 The Consequences of Weak Institutions

- 21.4.1 Local Corruption

- 21.4.2 Lack of Local Fiscal Capacity

- 21.4.3 Lack of Physical Capital

- 21.4.4 Rural to Urban Migration

- 21.4.5 A Case Study: The Hukou System

- 21.5 Natural Hazards

- 21.6 Conclusions

- 21.7 Technical Appendix: Solving the Optimal Taxation Problem

- 21.8 Debate: Transportation Infrastructure Investments in Jakarta

- 21.9 Problem Sets

- VII. Urban Land, Housing, and Labor Markets

- 22. The Internal Structure of Cities

- 22.1 Motivation

- 22.2 Traffic Congestion in Large US Cities

- 22.3 Modeling Internal City Structure

- 22.4 The Price of Land in New York City

- 22.5 Modern Models of the Internal Structure of Cities

- 22.6 Transportation Networks and City Structure

- 22.7 A Case Study: Congestion Pricing in Singapore and New York City

- 22.8 A Case Study: The NYC Subway Crisis

- 22.9 Conclusions

- 22.10 Technical Appendix: Endogenous Land Use

- 22.11 Debate: Public Transportation Infrastructure

- 22.12 Problem Sets

- 23. Land and Housing Markets

- 23.1 Motivation

- 23.2 The Hedonic Model of Housing

- 23.3 Using Hedonic Models in Empirical Work

- 23.4 Housing Prices in LA

- 23.5 Land Prices in NYC

- 23.6 Housing Policies and Regulation

- 23.6.1 Housing Supply Regulations

- 23.6.2 Rent Control and Rent Stabilization

- 23.6.3 Public Housing Policies

- 23.7 Conclusions

- 23.8 Technical Appendix: Computing the Equilibrium in the Hedonic Model

- 23.9 Debate: Zoning Policies in NYC

- 23.10 Problem Sets

- 24. Local Labor Markets

- 24.1 Motivation

- 24.2 The Urban Wage Premium

- 24.3 Modeling Differences in Local Labor Markets

- 24.3.1 A Baseline Model

- 24.3.2 Extensions

- 24.4 Theory and Measurement

- 24.5 Location-Based Policies

- 24.6 Conclusions

- 24.7 Debate: Attracting the “Creative Class”

- 24.8 Problem Sets

- 25. Homeownership, Mortgage Markets, and Default

- 25.1 Motivation

- 25.2 Measuring the Evolution of Housing Prices in a Market

- 25.3 The Moral Hazard of Renting and the Cost of Homeownership

- 25.4 A Case Study: Why Are Young Americans Not Buying Houses?

- 25.5 Mortgages and Default

- 25.6 Mortgage Markets

- 25.7 A Case Study: The Bailout of Fannie Mae and Freddie Mac

- 25.8 Mortgage Insurance

- 25.9 Conclusions

- 25.10 Debate: Subsidies for Homeownership

- 25.11 Problem Sets

- 26. Epilogue

- Appendix: Some Useful Techniques in Empirical Microeconomics

- A.1 Motivation

- A.2 Correlation versus Causation

- A.3 Probability Theory

- A.3.1 Random Variables

- A.3.2 Variance and Standard Deviation

- A.3.3 Multiple Random Variables

- A.3.4 Correlation

- A.3.5 Marginal and Joint Distributions

- A.3.6 Conditional Distributions

- A.3.7 Conditional Expectations

- A.3.8 Independence

- A.3.9 Some Useful Rules

- A.4 Statistics

- A.4.1 Random Sampling, Estimation, and Inference

- A.4.2 Estimating Conditional Expectations

- A.4.3 Linear Regressions

- A.4.4 Instrumental Variables

- A.4.5 Panel Data and Difference-in-Difference Estimation

- A.5 Causality and Social Experiments

- A.5.1 The Potential Outcome Model

- A.5.2 Average Treatment Effects

- A.5.3 An Example

- A.5.4 Selection Bias

- A.5.5 Randomized Experiments

- A.6 The Potential Outcome Model and the Regression Model

- A.7 Regression Discontinuity Design

- A.8 Discrete Choice Fundamentals

- A.9 An Application: Locational Choice Models

- A.10 Problem Sets

- References

- Index

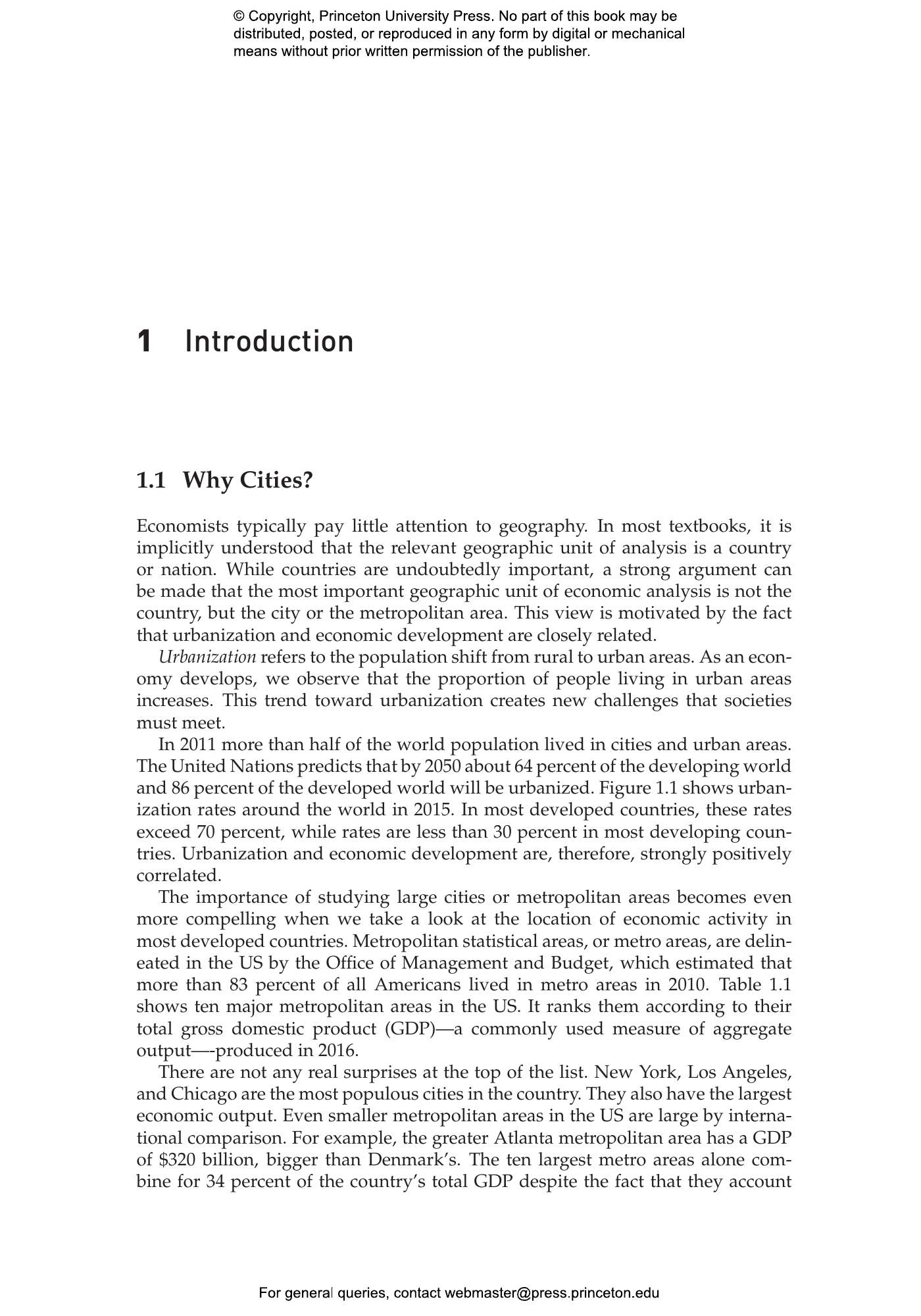

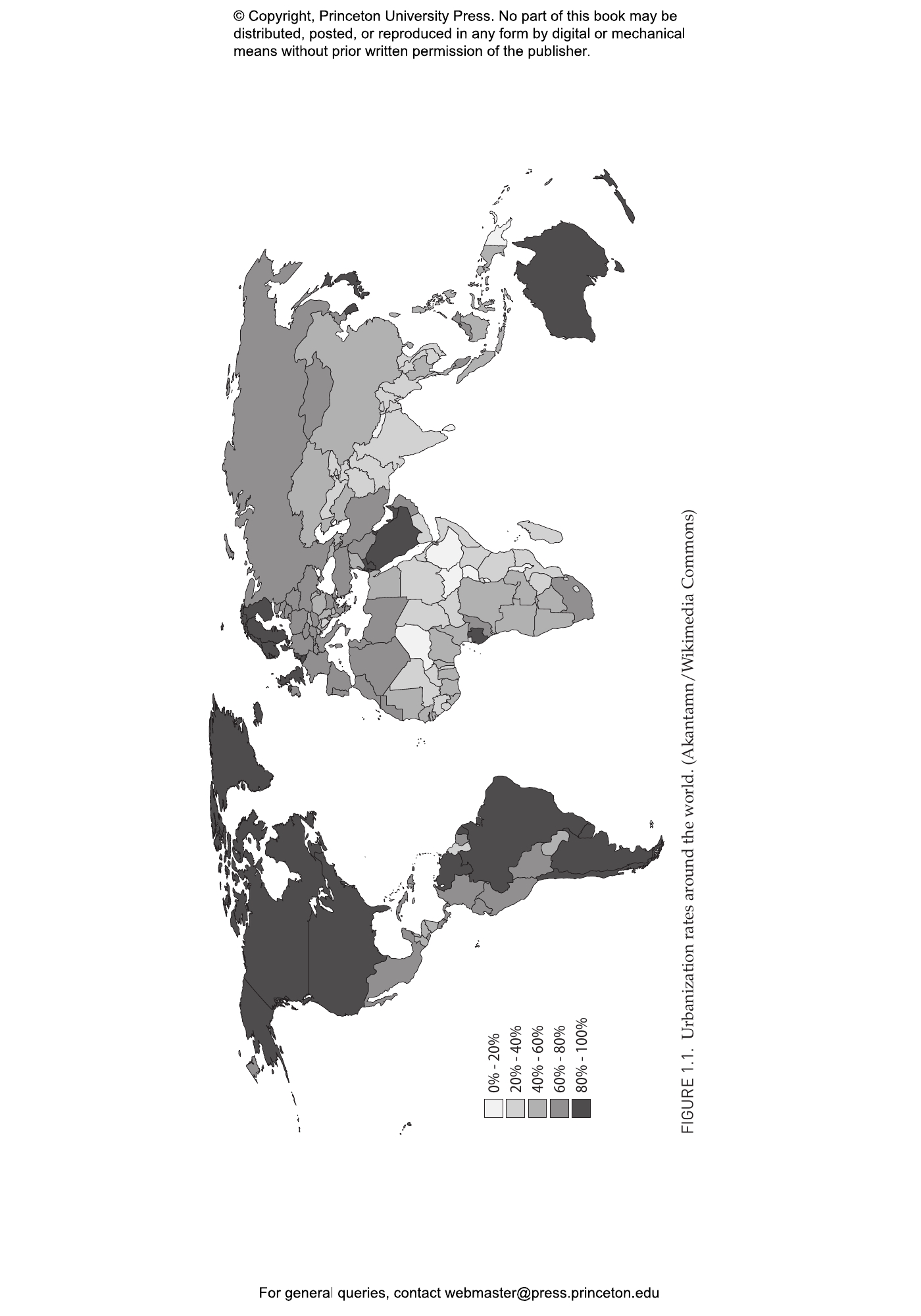

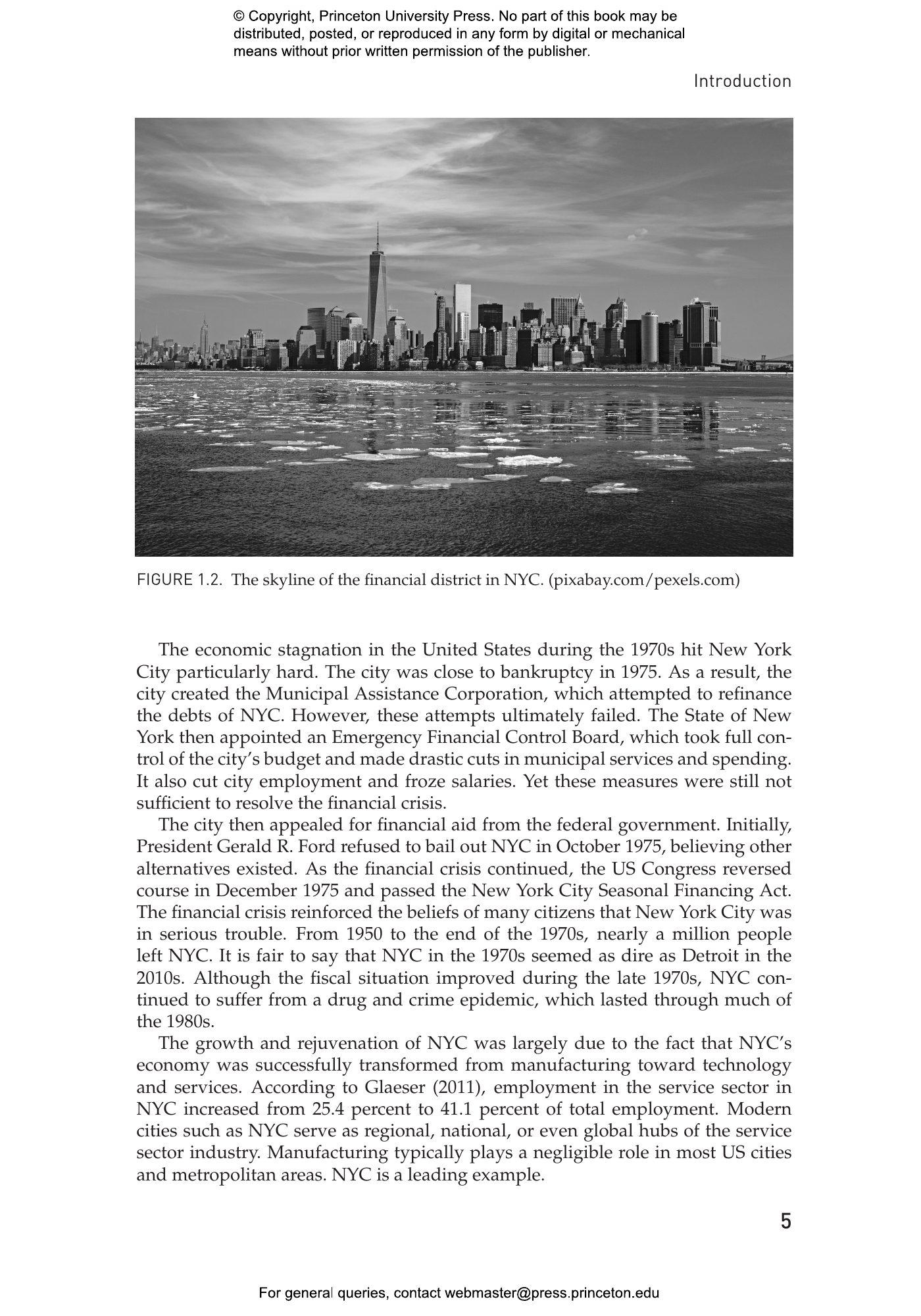

"Holger Sieg’s superb book offers an insightful and comprehensive analysis of modern urban economics and its most important implications for public policy. For those who are interested in economic geography, Urban Economics and Fiscal Policy offers analytical and empirical tools, presented in ways that are both rigorous and engaging."—Enrico Moretti, author of The New Geography of Jobs

"This incredibly comprehensive textbook will challenge and inspire students, as they are exposed to frameworks spanning the wide range of economic subfields relevant to urban issues. The book’s theoretical rigor is nicely balanced with intuitive narratives, modern empirical evidence, and real-world case studies."—Julie Cullen, University of California, San Diego

"Urban economics is undergoing a renaissance due to an increasing awareness that cities are central to understanding many economic phenomena. This seminal book is essential for all researchers interested in cities and for undergraduate and graduate courses in public finance and urban economics."—Stephen Redding, Princeton University

"This marvelous book offers extensive coverage of all the issues surrounding local public finance and the economics of cities and neighborhoods. With engaging writing that makes the most difficult concepts easily accessible, Urban Economics and Fiscal Policy is a wonderful teaching tool for advanced undergraduate students. It should also become the go-to reference for researchers in need of an introduction or a refresher on a specific issue. I enthusiastically recommend it."—Gilles Duranton, University of Pennsylvania

"Urban Economics and Fiscal Policy is a superb resource for undergraduate and graduate students interested in all types of economics related to cities. It provides a first-rate theoretical and empirical approach, presented in engaging ways."—Rebecca Diamond, Stanford University