In today’s financial markets, trading floors on which brokers buy and sell shares face-to-face have increasingly been replaced by lightning-fast electronic systems that use algorithms to execute astounding volumes of transactions. Trading at the Speed of Light tells the story of this epic transformation. Donald MacKenzie shows how in the 1990s, in what were then the disreputable margins of the US financial system, a new approach to trading—automated high-frequency trading or HFT—began and then spread throughout the world. HFT has brought new efficiency to global trading, but has also created an unrelenting race for speed, leading to a systematic, subterranean battle among HFT algorithms.

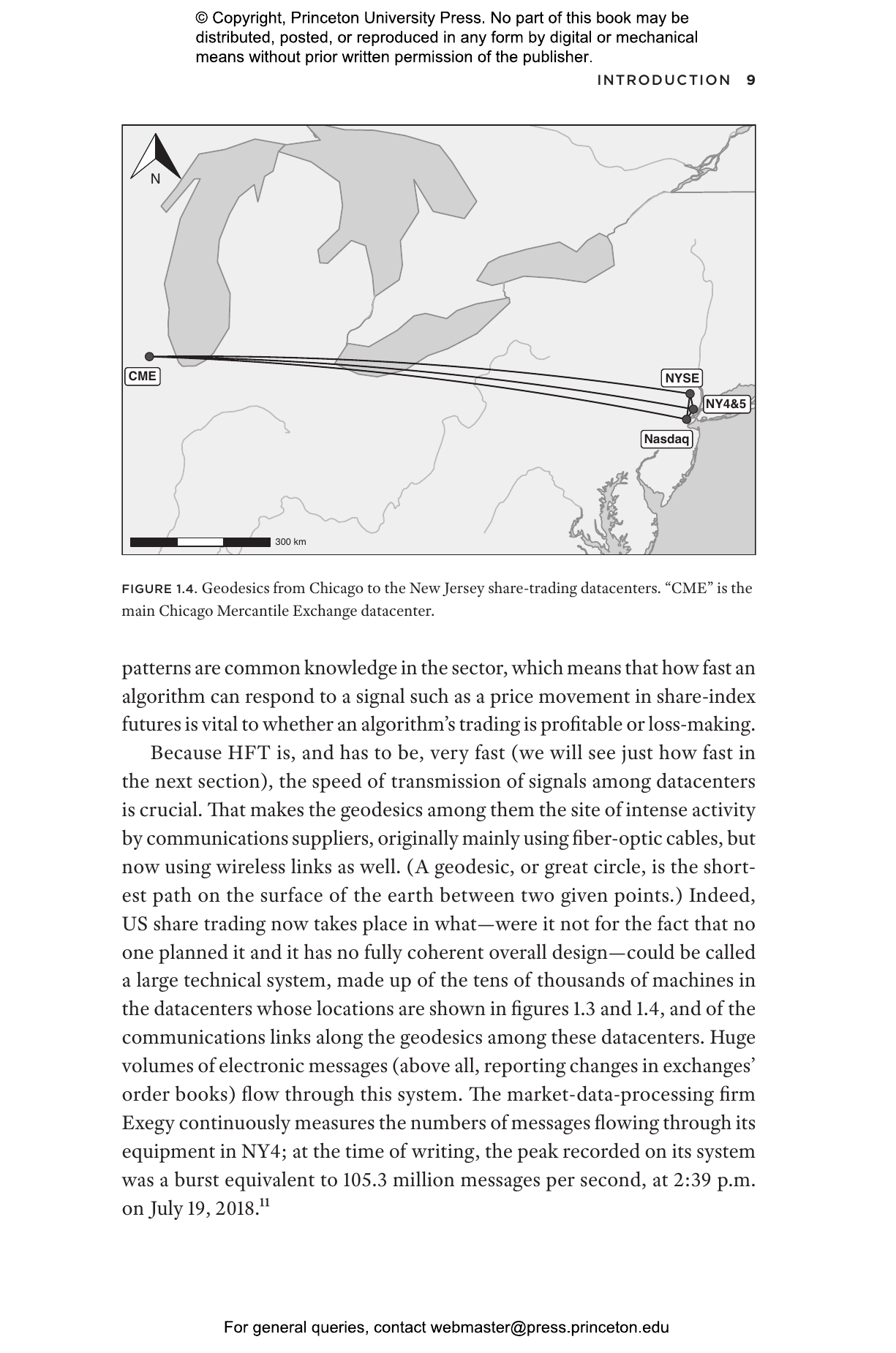

In HFT, time is measured in nanoseconds (billionths of a second), and in a nanosecond the fastest possible signal—light in a vacuum—can travel only thirty centimeters, or roughly a foot. That makes HFT exquisitely sensitive to the length and transmission capacity of the cables connecting computer servers to the exchanges’ systems and to the location of the microwave towers that carry signals between computer datacenters. Drawing from more than 300 interviews with high-frequency traders, the people who supply them with technological and communication capabilities, exchange staff, regulators, and many others, MacKenzie reveals the extraordinary efforts expended to speed up every aspect of trading. He looks at how in some markets big banks have fought off the challenge from HFT firms, and how exchanges sometimes engineer technical systems to favor certain types of algorithms over others.

Focusing on the material, political, and economic characteristics of high-frequency trading, Trading at the Speed of Light offers a unique glimpse into its influence on global finance and where it could lead us in the future.

Awards and Recognition

- Winner of the Bronze Medal in Business Technology, Axiom Business Book Awards

"I loved this book. . . . Trading at the Speed of Light is an amazing, detailed account of why material reality matters for virtual outcomes, and conversely, in the financial markets. Everybody with the slightest interest in modern finance should read it."—Diane Coyle, Enlightened Economist

"To understand the new sociality of high-frequency trading, one must grasp such trading’s new materiality. There is no better guide than Donald MacKenzie. In Trading at the Speed of Light, he makes it all come alive through extraordinary field research among the key players, fascinating accounts of the new technologies, and lucid prose. This is the social studies of finance at its very best."—David Stark, author of The Performance Complex

"Anyone who loves markets will love Trading at the Speed of Light. This is by far the best account yet of the arms race for trading speed, but it is so much more than that. It tells the origin story for HFT and modern electronic markets; paves new conceptual ground at the intersection of sociology, finance, and economics; and is written with a wonderful mix of academic depth, journalistic flair, engineering detail, and pure joy for the subject matter. Hundreds of interviews and decades of immersion have paid off big. Donald MacKenzie is one of a kind."—Eric Budish, University of Chicago

"The trading of stocks, bonds, and derivatives has grown enormously in the past forty years. Trading at the Speed of Light opens up this world by showing how the high-speed trading that underlays these markets is based on the interlocking nature of firms, algorithms, and tactics. Donald MacKenzie’s provocative and profound work shines light on the curious mix of market problems, technological limits, politics, and opportunities that explain this dynamic structuring."—Neil Fligstein, University of California, Berkeley

"Trading at the Speed of Light offers the most comprehensive and informative account of algorithmic trading, in particular high-frequency trading, to date. This scholarly masterpiece sheds light on the mechanics of present-day markets with such rich detail, it will undoubtedly stand as the authoritative sociological book on automated trading, its history, and material political economy. Equally impressive, the work explores highly technical terrain while remaining remarkably accessible. A truly extraordinary book."—Christian Borch, author of Social Avalanche

"Trading at the Speed of Light makes a significant and compelling contribution to the literature about trading in modern financial markets. With an engaging and effective approach, Donald MacKenzie explains high-frequency trading through the lenses of material, political, and economic factors. This book will be equally fascinating and appealing to general readers as it will be to a wide range of scholars."—Pamela C. Moulton, Cornell University

"A genuine compendium of rigor and sophisticated analysis, Trading at the Speed of Light is an absolute success. It will be read, not just by academics, but by policymakers as well, and will inspire a cohort of better informed regulators and economic sociologists. This book is a monumental scholarly achievement."—Daniel Beunza, author of Taking the Floor