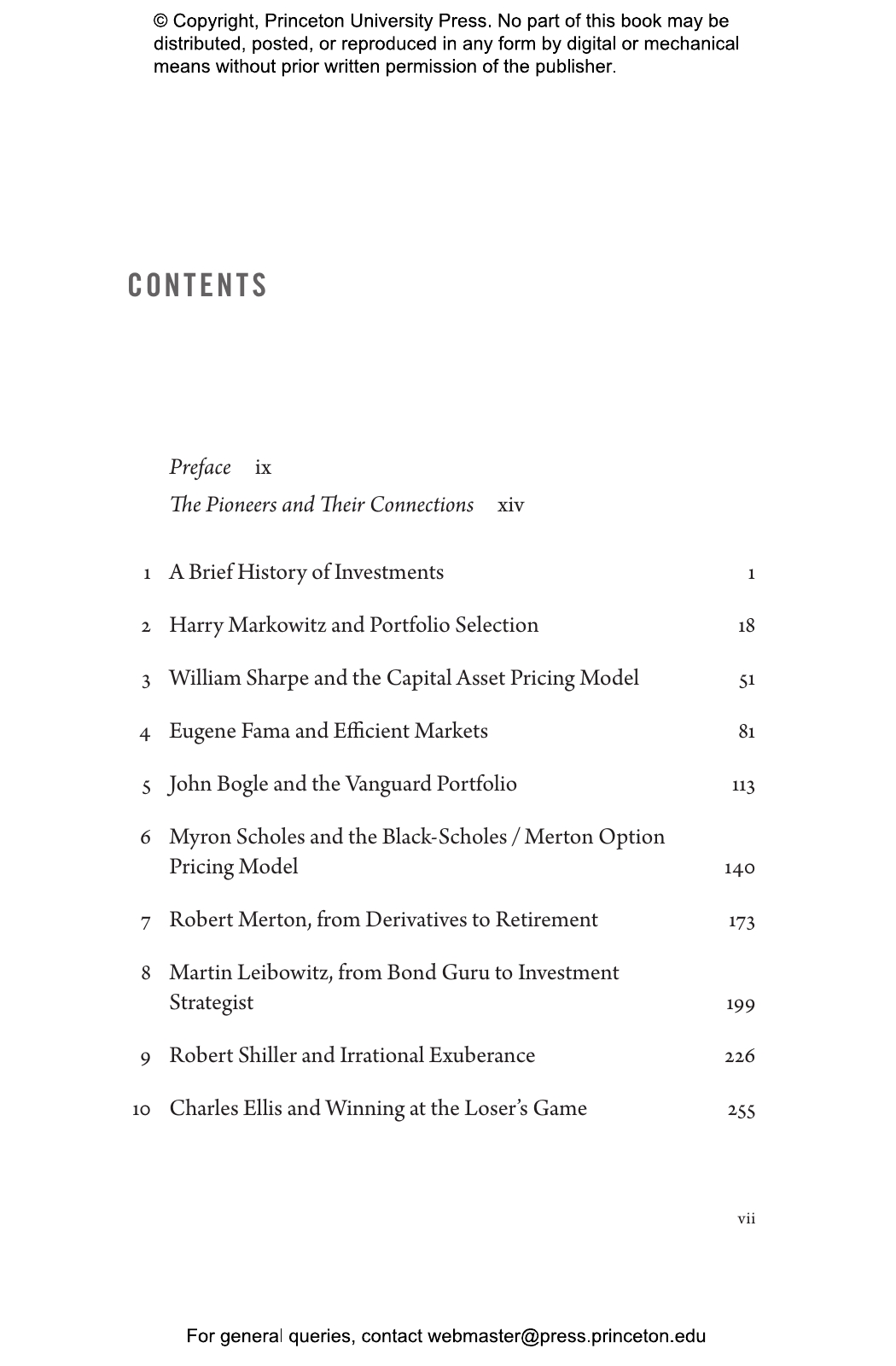

Is there an ideal portfolio of investment assets, one that perfectly balances risk and reward? In Pursuit of the Perfect Portfolio examines this question by profiling and interviewing ten of the most prominent figures in the finance world—Jack Bogle, Charley Ellis, Gene Fama, Marty Leibowitz, Harry Markowitz, Bob Merton, Myron Scholes, Bill Sharpe, Bob Shiller, and Jeremy Siegel. We learn about the personal and intellectual journeys of these luminaries—which include six Nobel Laureates and a trailblazer in mutual funds—and their most innovative contributions. In the process, we come to understand how the science of modern investing came to be. Each of these finance greats discusses their idea of a perfect portfolio, offering invaluable insights to today’s investors.

Inspiring such monikers as the Bond Guru, Wall Street’s Wisest Man, and the Wizard of Wharton, these pioneers of investment management provide candid perspectives, both expected and surprising, on a vast array of investment topics—effective diversification, passive versus active investment, security selection and market timing, foreign versus domestic investments, derivative securities, nontraditional assets, irrational investing, and so much more. While the perfect portfolio is ultimately a moving target based on individual age and stage in life, market conditions, and short- and long-term goals, the fundamental principles for success remain constant.

Aimed at novice and professional investors alike, In Pursuit of the Perfect Portfolio is a compendium of financial wisdom that no market enthusiast will want to be without.

Awards and Recognition

- Winner of the Silver Medal in Personal Finance / Retirement Planning / Investing, Axiom Business Book Awards

- One of Morningstar's Recommended Books of the Year

Andrew W. Lo is the Charles E. and Susan T. Harris Professor at the MIT Sloan School of Management, director of the MIT Laboratory for Financial Engineering, a principal investigator at the MIT Computer Science and Artificial Intelligence Laboratory, and an external faculty member at the Santa Fe Institute. His many books include Adaptive Markets and Hedge Funds (both Princeton). Twitter @AndrewWLo Stephen R. Foerster is professor of finance at Ivey Business School, Western University. He is the author of Financial Management: Concepts and Applications and Financial Management: A Primer. Twitter @ProfSFoerster

"What if you could get inside the minds of some of the greatest investors in history? It would be nice if you had a window straight into their heads, but in reality it would take years of hard work to learn to think the way they do. . . . Or, you could simply read. . . . In Pursuit of the Perfect Portfolio. "—Mark Reeth, Business Insider

"A good look at the development of portfolio theory, starting with Markowitz."—Tyler Cowen, Marginal Revolution

"An accessible and heady chronicle of how we build portfolios, how that’s changed, and why we’ve done it the way we’ve done it over time. How did investors come to coalesce around the 60/40 portfolio allocation, and what role do alternatives play in asset allocation? This readable book takes on those questions and many more"—Jeff Ptak, Morningstar

“This is a delightfully written account of the finance pioneers who have shaped our understanding of how to build optimal investment portfolios. Masterfully illuminating the lives and wisdom of Nobel Laureates and important investment professionals, In Pursuit of the Perfect Portfolio offers provocative insights for academics and practitioners.”—Burton G. Malkiel, author of A Random Walk Down Wall Street

“Throughout recorded history, people have looked to safeguard their future through the stewardship of their assets. This wonderful book describes how, in the twentieth century, a group of scholars and practitioners developed systematic approaches to this endeavor. By exploring the differences between these pioneers, In Pursuit of the Perfect Portfolio puts forth a framework that enables each of us to reflect on our own investment portfolios.”—Diane Coyle, University of Cambridge

“Ever wonder if there is a better way to invest? In Pursuit of the Perfect Portfolio does a marvelous job setting out answers by taking readers through the evolution of modern investment management. Combining interesting anecdotes with fulsome explanations, the authors provide a road map for how portfolio selection has developed. Accessible to new and experienced investors, this book makes clear that the search for the perfect portfolio is an engaging and never-ending quest.”—Maureen O’Hara, former president of the American Finance Association

“Lo and Foerster tell the stories of ten innovators that helped to produce a revolution in the investing field these past fifty years. The authors delve into the personal histories of these individuals and explain how their innovations have improved investment experiences for millions of investors, big and small. This entertaining book gives a great overview of the development of modern finance.”—David G. Booth, chairman of Dimensional Fund Advisors

“Lo and Foerster construct a ‘perfect portfolio’ of intimate biographies and divergent yet complementary ideas that will inform today’s most thoughtful investors. Not only does this book help individuals determine what approach would best suit them, it also offers institutions a tantalizing blueprint for better personalized investment solutions.”—Peter Hancock, former president and CEO of AIG and former CFO of J. P. Morgan

“Lo and Foerster have produced an essential book on investing. Everyone should read In Pursuit of the Perfect Portfolio to find out what featured Nobel Laureates and investment thought leaders have to say about choosing the right portfolio mix. The authors do a splendid job of explaining in nontechnical language the similarities and differences in approach among those profiled.”—Zvi Bodie, coauthor of Investments

“This highly rewarding book walks us through the foundations of modern portfolio theory and incorporates the powerful insights of the practitioners who helped make it all happen. A perfect read!”—Ben Golub, chief risk officer of BlackRock