This book provides the most comprehensive treatment of the theoretical concepts and modelling techniques of quantitative risk management. Whether you are a financial risk analyst, actuary, regulator or student of quantitative finance, Quantitative Risk Management gives you the practical tools you need to solve real-world problems.

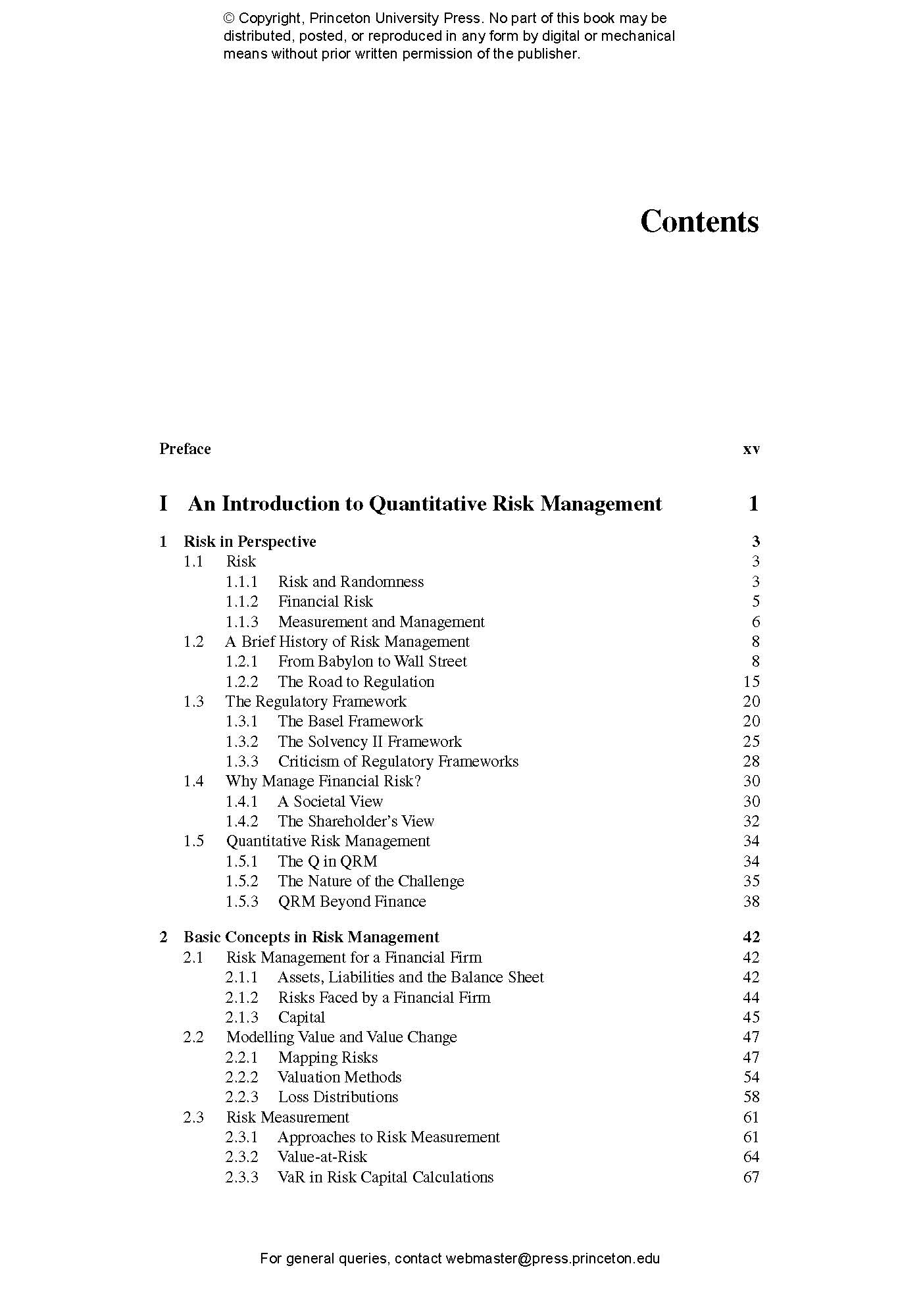

Describing the latest advances in the field, Quantitative Risk Management covers the methods for market, credit and operational risk modelling. It places standard industry approaches on a more formal footing and explores key concepts such as loss distributions, risk measures and risk aggregation and allocation principles. The book’s methodology draws on diverse quantitative disciplines, from mathematical finance and statistics to econometrics and actuarial mathematics. A primary theme throughout is the need to satisfactorily address extreme outcomes and the dependence of key risk drivers. Proven in the classroom, the book also covers advanced topics like credit derivatives.

- Fully revised and expanded to reflect developments in the field since the financial crisis

- Features shorter chapters to facilitate teaching and learning

- Provides enhanced coverage of Solvency II and insurance risk management and extended treatment of credit risk, including counterparty credit risk and CDO pricing

- Includes a new chapter on market risk and new material on risk measures and risk aggregation

Awards and Recognition

- One of the Top 10 Technical Books on Financial Engineering by Financial Engineering News for 2006

"Praise for the previous edition: "This book provides a state-of-the-art discussion of the three main categories of risk in financial markets, market risk, . . . credit risk . . . and operational risk. . . . This is a high level, but well-written treatment, rigorous (sometimes succinct), complete with theorems and proofs.""—D.L. McLeish, Short Book Reviews of the International Statistical Institute

"Praise for the previous edition: "A great summary of the latest techniques available within quantitative risk measurement. . . . [I]t is an excellent text to have on the shelf as a reference when your day job covers the whole spectrum of quantitative techniques in risk management.""—Financial Engineering News

"Praise for the previous edition: "Alexander McNeil, Rudiger Frey and Paul Embrechts have written a beautiful book. . . . [T]here is no book that can provide the type of rigorous, detailed, well balanced and relevant coverage of quantitative risk management topics that Quantitative Risk Management: Concepts, Techniques, and Tools offers. . . . I believe that this work may become the book on quantitative risk management. . . . [N]o book that I know of can provide better guidance.""—Dr. Riccardo Rebonato, Global Association of Risk Professionals (GARP) Review

"Praise for the previous edition: "This is a very impressive book on a rapidly growing field. It certainly helps to discover the forest in an area where a lot of trees are popping up daily.""—Hans Bühlmann, SIAM Review

"Praise for the previous edition: "This book is a compendium of the statistical arrows that should be in any quantitative risk manager's quiver. It includes extensive discussion of dynamic volatility models, extreme value theory, copulas and credit risk. Academics, PhD students and quantitative practitioners will find many new and useful results in this important volume.""—Robert F. Engle III, 2003 Nobel Laureate in Economic Sciences, Michael Armellino Professor in the Management of Financial Services at New York University's Stern School of Business

"Praise for the previous edition: "Quantitative Risk Management can be highly recommended to anyone looking for an excellent survey of the most important techniques and tools used in this rapidly growing field.""—Holger Drees, Risk

"Praise for the previous edition: "Quantitative Risk Management is highly recommended for financial regulators. The statistical and mathematical tools facilitate a better understanding of the strengths and weaknesses of a useful range of advanced risk-management concepts and models, while the focus on aggregate risk enhances the publication's value to banking and insurance supervisors.""—Hans Blommestein, Financial Regulator

"Praise for the previous edition: "This book provides a framework and a useful toolkit for analysis of a wide variety of risk management problems. Common pitfalls are pointed out, and mathematical sophistication is used in pursuit of useful and usable solutions. Every financial institution has a risk management department that looks at aggregated portfolio-wide risks on longer time scales, and at risk exposure to large, or extreme, market movements. Risk managers are always on the lookout for good techniques to help them do their jobs. This very good book provides these techniques and addresses an important, and under-developed, area of practical research.""—Martin Baxter, Nomura International

"Praise for the previous edition: "For anyone searching for a book dedicated to the concepts in risk management and the quantitative methodologies with a particular emphasis on the mathematical rigor, this is the one to read.""—Chen Zhou, Extremes

Praise for the previous edition: "McNeil, Frey, and Embrechts present a wide-ranging yet remarkably clear and coherent introduction to the modelling of financial risk. Unlike most finance texts, where the focus is on pricing individual instruments, the primary focus in this book is the statistical behavior of portfolios of risky instruments, which is, after all, the primary concern of risk management. This ought to be a core text in every risk manager's training, and a useful reference for experienced professionals."—Michael Gordy

Praise for the previous edition: "There is no book that provides the type of rigorous and detailed coverage of risk management topics that this book does. This could become the book on quantitative risk management."—Riccardo Rebonato, Royal Bank of Scotland, author of Modern Pricing of Interest-Rate Derivatives